Any e-Commerce business should consider its customer needs first when selecting which online payment methods to use. In this article, GetApp looks at consumer concerns about online shopping and how it can affect their purchasing behaviour and preferred ways to pay.

In this article

How aware are consumers of the risks of online shopping scams, such as hacking, fake websites selling counterfeit products, and credit card identity theft? The pandemic saw a global increase in online shopping, but it also brought a wave of digital commerce fraud along with it.

To find out how online shopping in Australia affects consumer trust in e-Commerce sites and transactions, we interviewed over 1,000 online shoppers about their purchase behaviours, experiences, and preferred online payment methods. The full survey methodology can be found at the bottom of this page.

Online shopping behaviours of Australian consumers

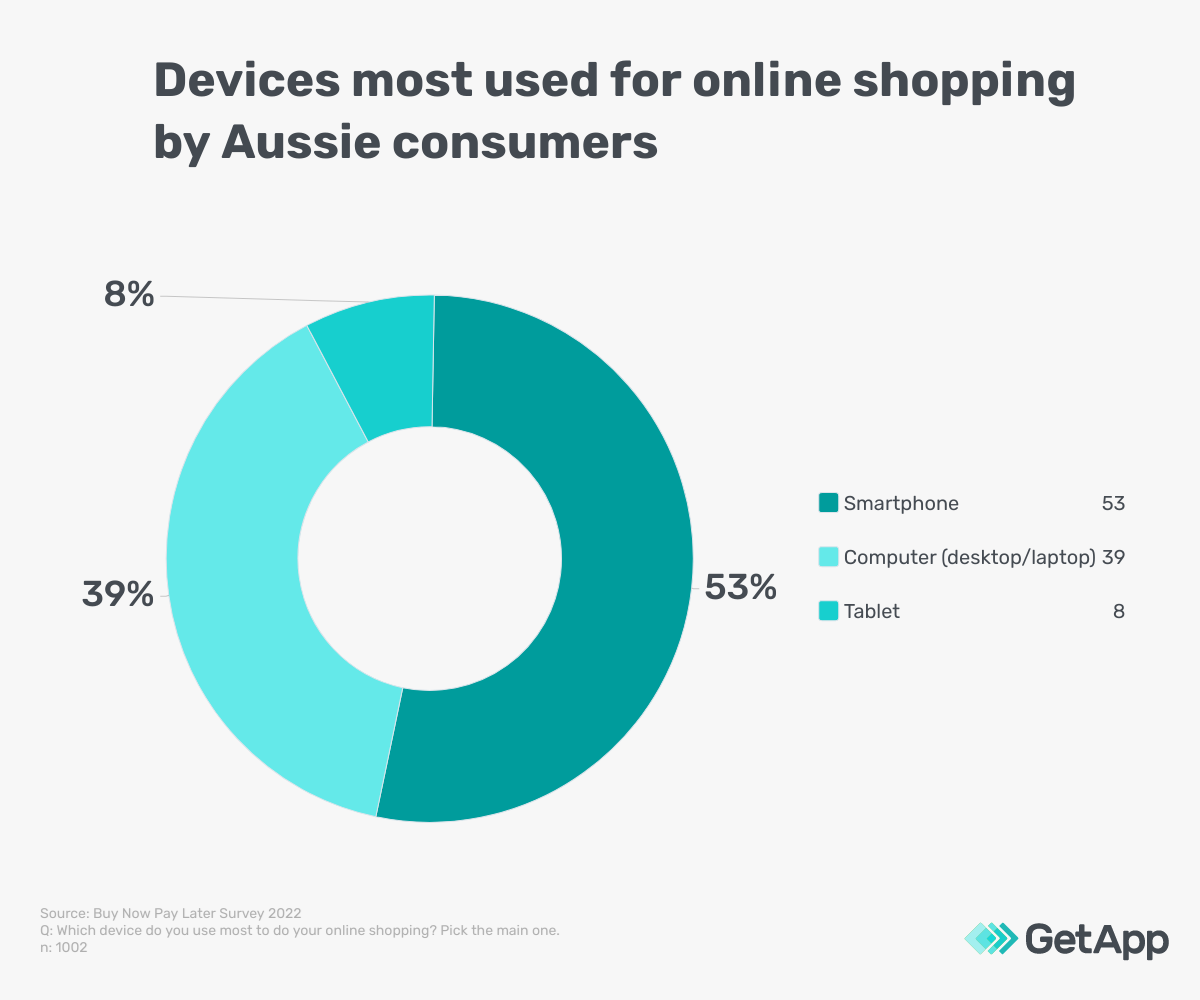

The use of mobile commerce (or m-commerce) is on the rise in Australia, as many users are likely to always have their smartphone to hand with direct access to the Internet. GetApp’s survey found that consumers are happy to opt for the smaller gadget over a computer, as 53% of survey-takers said they used the smartphone the most when online shopping. M-commerce, an increasingly large subset of e-Commerce, has grown in popularity during the pandemic because of a rapid increase in online sales.

- M-commerce consists of mobile shopping, mobile banking, or mobile payments.

- Customers can make purchases from a smartphone or tablet using applications such as Amazon, eBay, or via the vendor’s/brand’s own website.

- M-commerce has played a key role in digital transformation for many businesses during post-pandemic recovery.

GetApp asked consumers how often they buy from a variety of different online platforms. A combined total of 79% said they frequently buy straight from the vendor’s/brand website the most (46% said they “sometimes” buy from here and 33% said they “often” do). Social commerce , where all or part of the customer shopping journey takes place on social networks, is also having an impact on consumers’ buying habits. Similar to m-commerce, social commerce is a growing shopping trend.

41% of survey-takers said that they frequently buy from social media channels such as Facebook or Instagram. By using social commerce, SMEs can appeal to a larger audience and increase their brand reach. Social media thrives on community engagement. It can create an experience where users want to share their favourite brands and encourage others to visit the brand’s site for shopping.

PayPal is the most commonly preferred online payment method

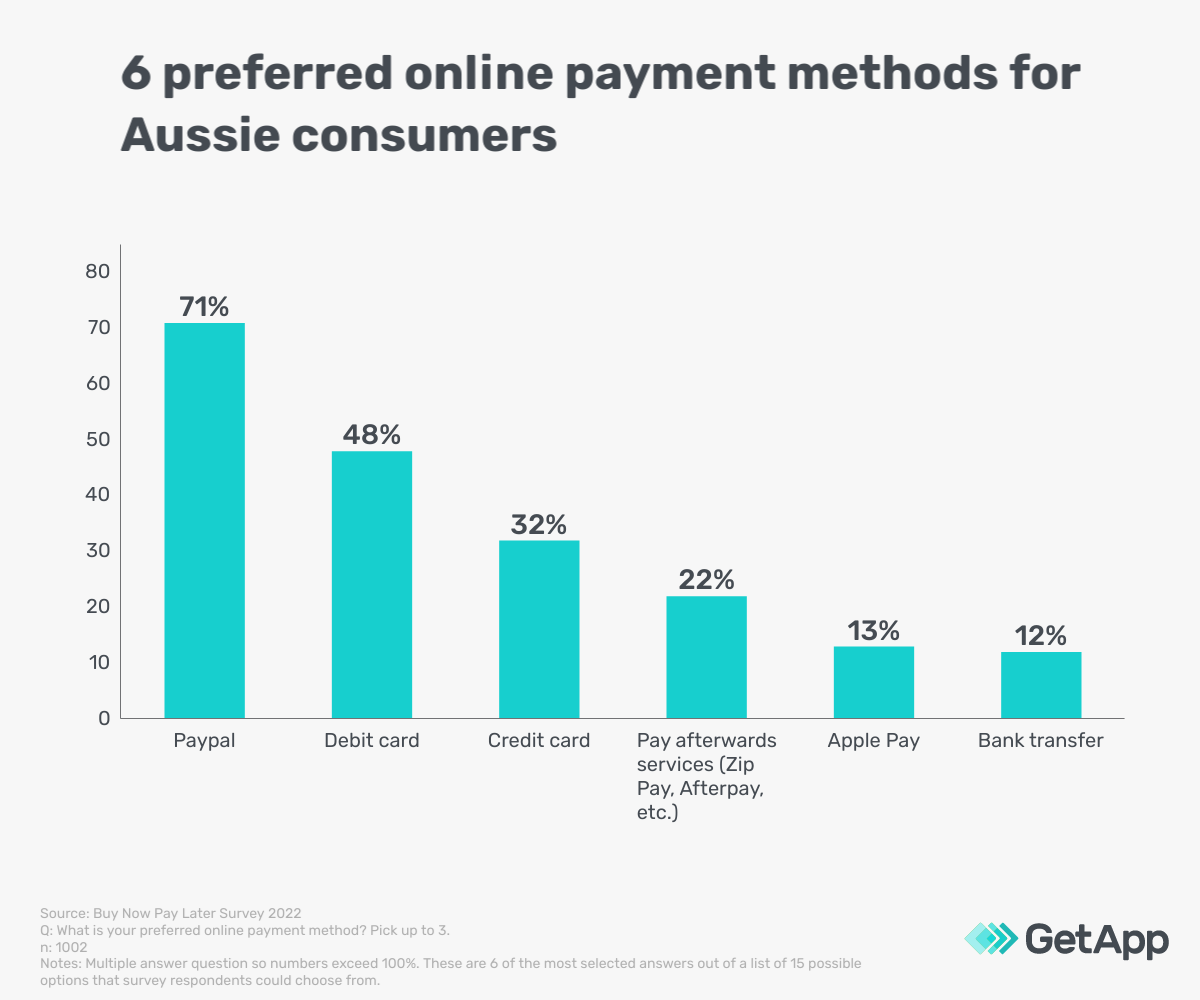

PayPal is currently the number one online payment method for Australian shoppers, even as competitive schemes like buy now, pay later (BNPL) have been growing in the global e-Commerce marketplace over the last few years. When asked to pick their three preferred online payment methods by GetApp, 71% of survey-takers chose the global online payment system PayPal.

PayPal services

PayPal recently launched its own BNPL service in Australia called Pay in 4, which according to the company, was requested by their customers. In the US, PayPal has introduced Pay Monthly, enabling US consumers to make larger purchases of up to 10,000 USD with repayment spread over a 24-month period if necessary.

GetApp’s survey found that 48% of respondents prefer to use the more traditional payment method of a debit card, whilst 32% said credit card. PayPal, however, has also launched its own credit card called PayPal Rewards Card.

But what do online shoppers do if their preferred way to pay is unavailable? Half of respondents (50%) said they buy the product with another payment method. But nearly a quarter of survey-takers (24%) said they stop the checkout process and don’t buy the chosen product. A further 23% look for the same product in a different online shop, which highlights a significant loss in business for e-Commerce sites.

Having multiple payment methods available is vital as an effective way of gaining customer loyalty. Offering multiple payment options brings a positive experience to the consumer and may encourage them to come back again in the future. Ultimately, it can boost conversion rates.

Consumer concerns with making online payments

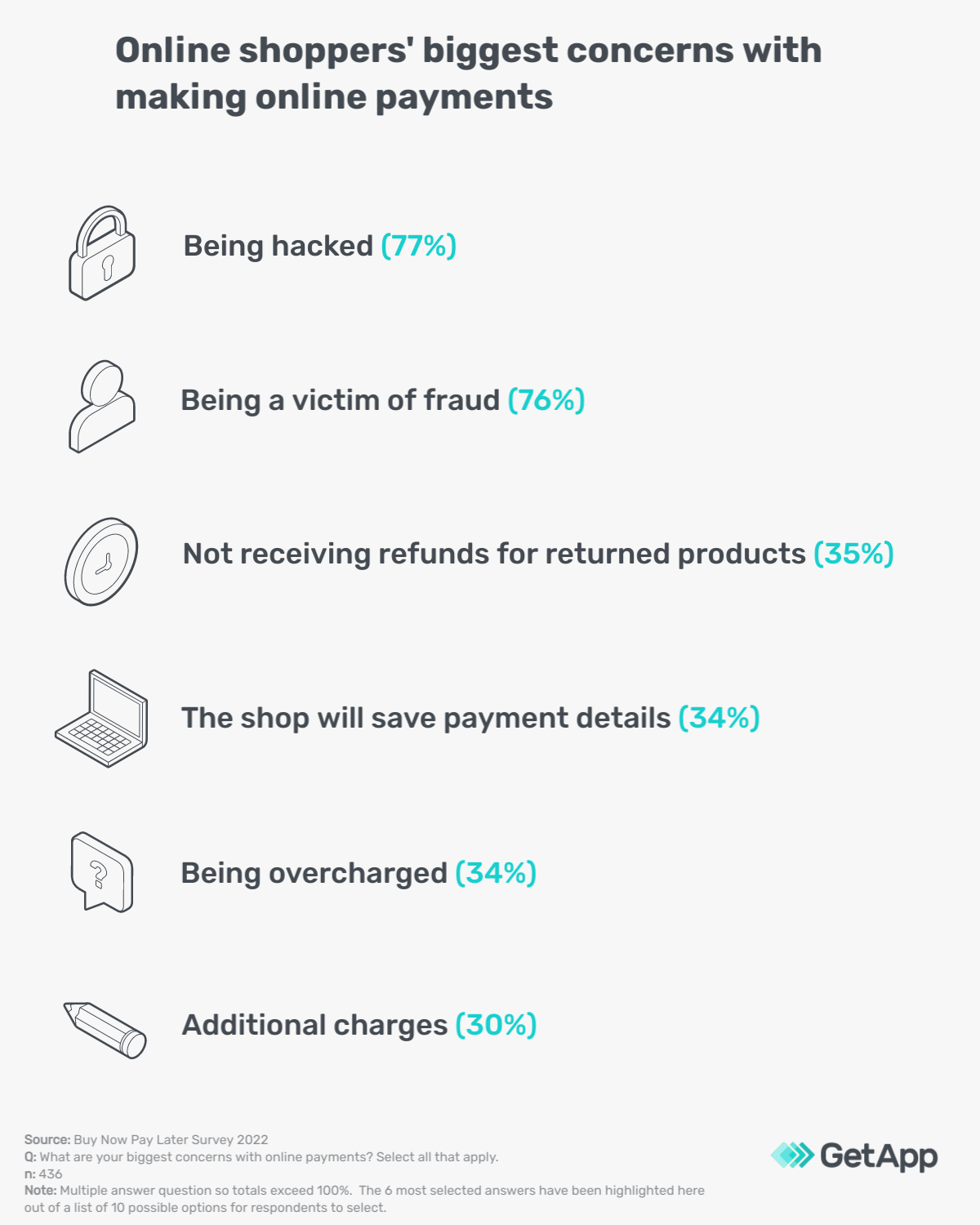

When shopping online, it goes without saying that it’s important for consumers to be careful and for SMEs to have cybersecurity measures in place. 44% of those surveyed by GetApp said they are concerned about making online payments. 77% of respondents who were concerned said that one of their biggest worries is being hacked. This was closely followed by being a victim of fraud (76%), and thirdly the fear of not receiving refunds for returned products (35%).

Payment security issues may be a worry for both online retailers and consumers, especially as the pandemic has led to an increase in online shopping and hackers. A payment processing platform with advanced data security may protect customers’ credit and debit card numbers, date of birth, and other personal information from being exposed to cybercriminals.

The victims of online shopping scams

The biggest threats of Internet shopping are online fraud and hacking, which was reflected in GetApp’s survey.

Those who were a victim of fraud said the most common method the cybercriminal used was a fake store with fake products (37%). Counterfeit products can include fake designer clothes, handbags, and electronics, for example, and may lure consumers with cheap versions of a well-known brand’s products. It is therefore important that retailers invest in stopping the problem by educating their consumers, particularly about buying from unauthorised sources. Brands can also use tools that enable them to monitor and track where counterfeit versions of their product can be found online.

38% of consumers were not sure what hacking methods were used to steal their details, which may be because many hackers can go undetected for a long period of time. 35% of consumers who were hacked said that their payment details were stolen from the website/vendor’s database. A security breach of an e-Commerce site could lead to the loss of customer data, which may have devastating impacts on the company’s reputation.

Best practices for e-Commerce security

e-Commerce sites can implement the following for strong security:

– Use strong passwords and ensure customers do too

– Protect devices with anti-virus software and firewalls

– Train staff to never click links in suspicious emails

– Implement 2-step verification, 2-factor authentication, or multi-factor authentication

– Only store customer data that is actually required and nothing more

– Switch to secure HTTPS, which requires an SSL certificate

– Back up the business data

54% of online shoppers only use trusted online retailers

Over half of the online shoppers (54%) surveyed by GetApp say they use trusted or well-known retailers when ensuring that the online shop they are buying from is secure. This was followed by 45% of online consumers who said they go by the reputation of an online shop. Checking customer reviews on a third-party website to ensure that the online shop is secure was the third most selected option by 40% of survey-takers.

In order to make customers feel secure when online shopping, organisations can implement a personal touch through the use of a live chat agent or with fast responses to customer queries via social media channels. Knowing there is a dedicated customer support team on standby can help reassure shoppers that an e-Commerce page is safe. Another strategy is to display any security banners, logos, and other trust symbols in the footer of the site and on payment pages.

Including the offer of a complete money-back guarantee may also make customers feel safe about spending money on the site if they know that there is the possibility to get it back. Implementing these measures can help with an organisation’s online security reputation and gain consumer trust.

- The smartphone is the most-used device for online shopping by Australian consumers as, partly thanks to the pandemic, m-commerce is becoming an increasingly popular way to shop.

- Consumers most frequently buy from the vendor/brand’s website, but social commerce is gaining traction and looks to be the future of online shopping.

- PayPal currently remains the commonly preferred online payment method for Aussie consumers, more so than the traditional credit or debit card.

- Online shoppers are most concerned about being hacked or victims of fraud when it comes to online shopping scams.

- Over half of consumers use what they believe to be trusted online retailers, which highlights how imperative it is for e-Commerce sites to have a strategy in place that makes shoppers feel secure about their choice of online payment methods.

Methodology

To collect data for this report, GetApp conducted an online survey in April 2022. Of the total participants, we were able to identify 1,002 respondents who fit the following criteria:

- Australian residents

- Aged over 18 years old and under 75 years old

- Employed by a company with under 250 employees

- Shop online at least once every month