Are Australian customers concerned about digital wallet platforms collecting their data? In this second part of our two-part series, we will discuss which factors and conditions can help Australian users move to digital wallet payment options.

In this article

Digital wallets can be convenient payment options, but there is also a potential risk of losing your personal and financial data if not used cautiously. But are Australian consumers ready to go completely digital? What percentage of them would be interested in a cashless system? What are their different concerns about it?

To understand the different consumer privacy concerns about digital wallets, GetApp surveyed 1,005 participants who are smartphone users and understand what digital wallets are. We interviewed these respondents to understand their general feelings and concerns about digital wallet usage and whether they would be interested in stopping cash usage altogether. The first part of this survey focused on how respondents use digital wallets, how frequently they use them, and which is their most preferred digital wallet platform. The full methodology for this part can be found at the bottom of this article.

68% of respondents are concerned about data collection

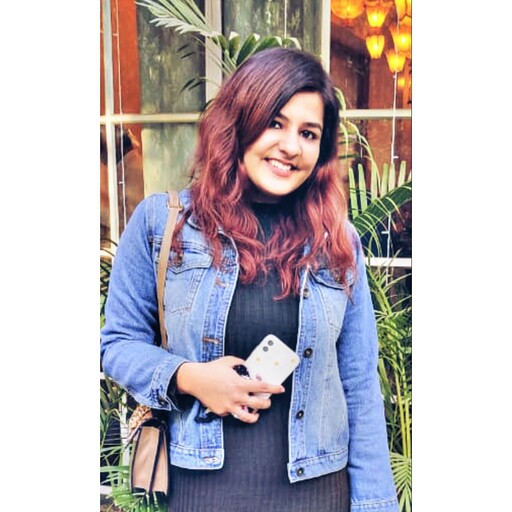

While evaluating different consumer aspects, we asked the respondents who use digital wallets as debit/credit cards (79%) about their concerns regarding digital wallets collecting their spending data, and these are their answers:

As per our survey results, a combined total of 68% of respondents are concerned about digital wallets collecting their spending data —with 41% of them being somewhat and 27% being extremely concerned.

In addition, we asked those respondents who expressed concern about whether that impacts their digital wallet usage. This is what they answered:

- 42% of the respondents said privacy concerns do not affect their digital wallet usage

- 36% said that because of this concern, they now try to use digital wallets only on some occasions

- 22% of the surveyed respondents said they are trying to stop using digital wallets altogether

An interesting point to note here is that though the majority of the respondents expressed concerns, that does not affect the digital wallet usage of a significant proportion of users.

Is the government doing enough for data privacy protection?

Delving more into understanding the role of the government, we asked respondents who use digital wallets as debit/credit cards the following question: ‘Do you believe the government is doing enough to regulate how information collected from digital wallets is stored and used?’. While 38% of the respondents stated that the government is helping enough, 25% disagreed, and the remaining 37% were not sure.

Moreover, we further asked them to state their opinion on whether financial companies that offer digital payment methods are doing enough to protect digital payment information. Out of all the responses, 46% of them stated that yes, such companies were doing enough, while 24% of the respondents said ‘no’, and 29% said they were not so sure.

64% find it easier to prove identity with digital wallets

The survey-takers were asked whether digital wallets make them feel more or less in control of their identity. Surprisingly, of those respondents who use digital wallets as debit/credit cards, 64% feel that digital wallets actually make it easier for them to demonstrate their identity. The potential reasons digital wallets might seem like an easier way to demonstrate identity could be:

- Presenting or submitting physical copies of sensitive documents might lead to identity fraud and other criminal activities. In such cases, digital wallets might provide users with the flexibility to control what information they are willing to share.

- In case of any changes in identity documents, digital wallets can get updated potentially faster and in real-time, without users having to wait for physical cards or documents to arrive.

- Digital wallets can also possibly save time and help users avoid long queues. For instance, a passenger can straightforwardly get through airport boarding gates using a smartphone without needing to wait in line for a physical boarding pass.

Majority willing to start going completely cashless

Moving forward, we asked those respondents who use digital wallets as debit/credit cards their agreement or disagreement on whether they are willing to stop using cash and start using only digital payments. To that, a combined total of 66% of respondents agreed with the statement and said that they are willing to use only digital payments —with 36% somewhat and 30% strongly agreeing.

The first part of this survey also indicated that out of the current digital wallet users, 78% find digital wallets more convenient than corresponding traditional methods, followed by other advantages such as not having to carry physical wallets, finding it easier to track their use, and digital wallets potentially helping to minimise fraud cases.

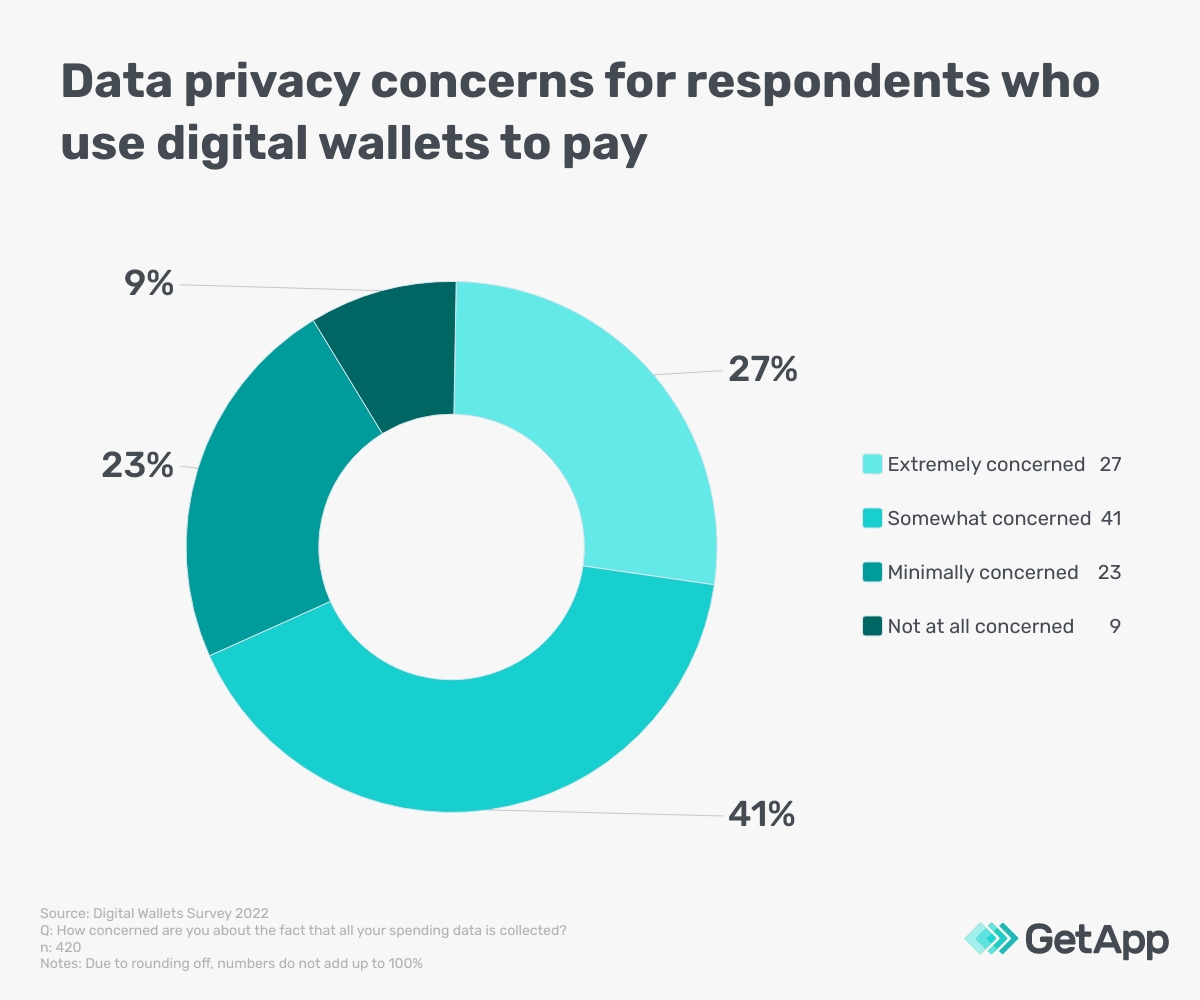

61% are interested in having a society-wide cardless system

On further evaluating Australian consumer behaviour, we asked those respondents who use digital wallets as debit/credit cards whether they are interested in having a society-wide cardless system. A combined total of 61% of survey-takers agree with this statement, with 36% somewhat and 25% strongly agreeing with having a cardless system in society. A cardless society in this sense could involve completely ditching physical debit/credit cards as a payment method and fully moving to digital platforms such as Apple Pay and Google Pay.

Having said that, a combined total of 67% of respondents also prefer to always carry some cash with them. Another important thing to note here is that on one side, the majority agree to move to digital payments completely. On the other hand, they also prefer to always carry cash with them.

56% feel neutral trust towards traditional banks

We asked surveyed respondents how much they trust their traditional banks, and this is what they answered:

- 56% of the respondents feel neutral about their traditional banks

- 29% have complete faith in their traditional banks, and

- The remaining 15% of the survey-takers do not trust traditional banks

The survey data clearly shows that a majority of the respondents have neutral trust feelings towards their traditional banks. This might mean that some consumers still feel sceptical about switching to digital banking completely. The first part of this survey also indicated that some respondents were actually hesitant when it comes to digital wallets. The reasons stated by the respondents included unwillingness to store confidential information in smartphones and not wanting to rely completely on technology, among many other reasons.

45% are interested in a decentralised financial environment

Continuing ahead, we asked survey-takers whether they would be interested in a decentralised financial environment with little or no control over people’s money.

What is a decentralised financial setup?

A decentralised financial setup generally means a system that potentially eliminates the need for an established financial system. In this system, any person can use financial services regardless of their background and geographical location. Such a setup could offer customers different financial products without the involvement of banks and other controlled exchanges.

A combined total of 45% showed interest in such a setup —with 24% saying they are highly interested and 21% saying ‘yes’ but that it would be difficult to apply. Moreover, 28% would not prefer such a system, while 27% are not sure.

In conclusion

According to CEOWORLD magazine, ‘from the beginning of the pandemic till now the payments through smartphones have become very common following continuous growth’. The article also states that the number of people choosing digital wallets for payment purposes has also increased in recent years. Based on our survey in this two-part series, we observed that the majority of Australian customers are willing to use digital wallets but are also concerned about their data privacy.

Businesses offering the option of digital wallet payments can perhaps add extra layers of security to increase financial protection. The reluctance and hesitation to this technology could be considered natural, but as people start to see the potential comfort and ease this technology offers, digital wallets may start to gain more acceptance.

Methodology

To collect data for this report, GetApp conducted an online survey from 27 September to 7 October 2022, gathering the participation of 1,005 respondents. The selection criteria for participants were as follows:

- Australian resident.

- Over 18 and below 76 years old.

- Have a smartphone.

- People who read and understood the definition of digital wallets in the survey questionnaire: ‘Digital wallets are smartphone/smartwatch apps that can store payment details and different types of ID/credentials (credit card details, gift cards, tickets, driver’s license, etc.) and allow users to pay without using a physical credit/debit card or to identify themselves and/or enter a place without a physical ID, credential or ticket’.