PayEm

About PayEm

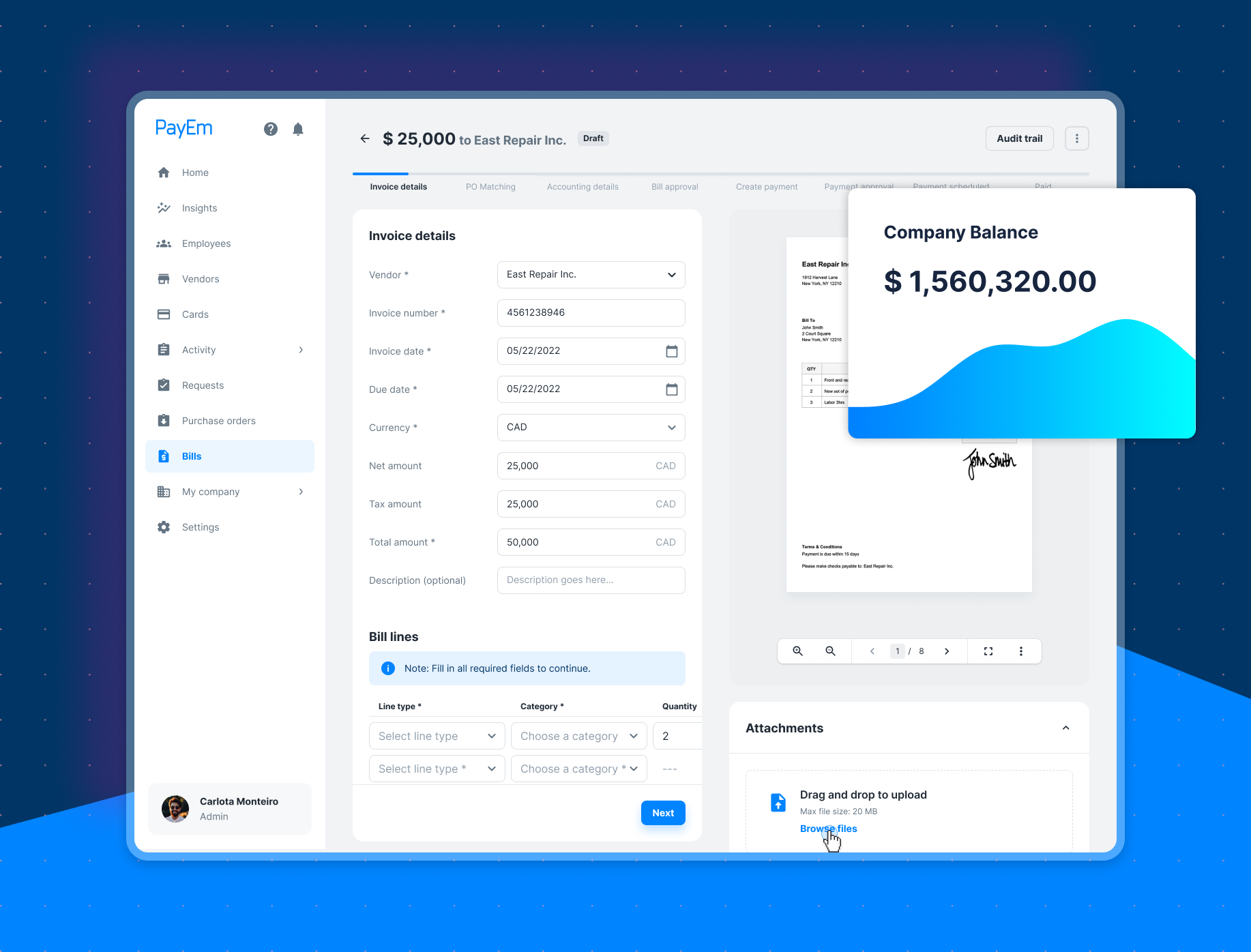

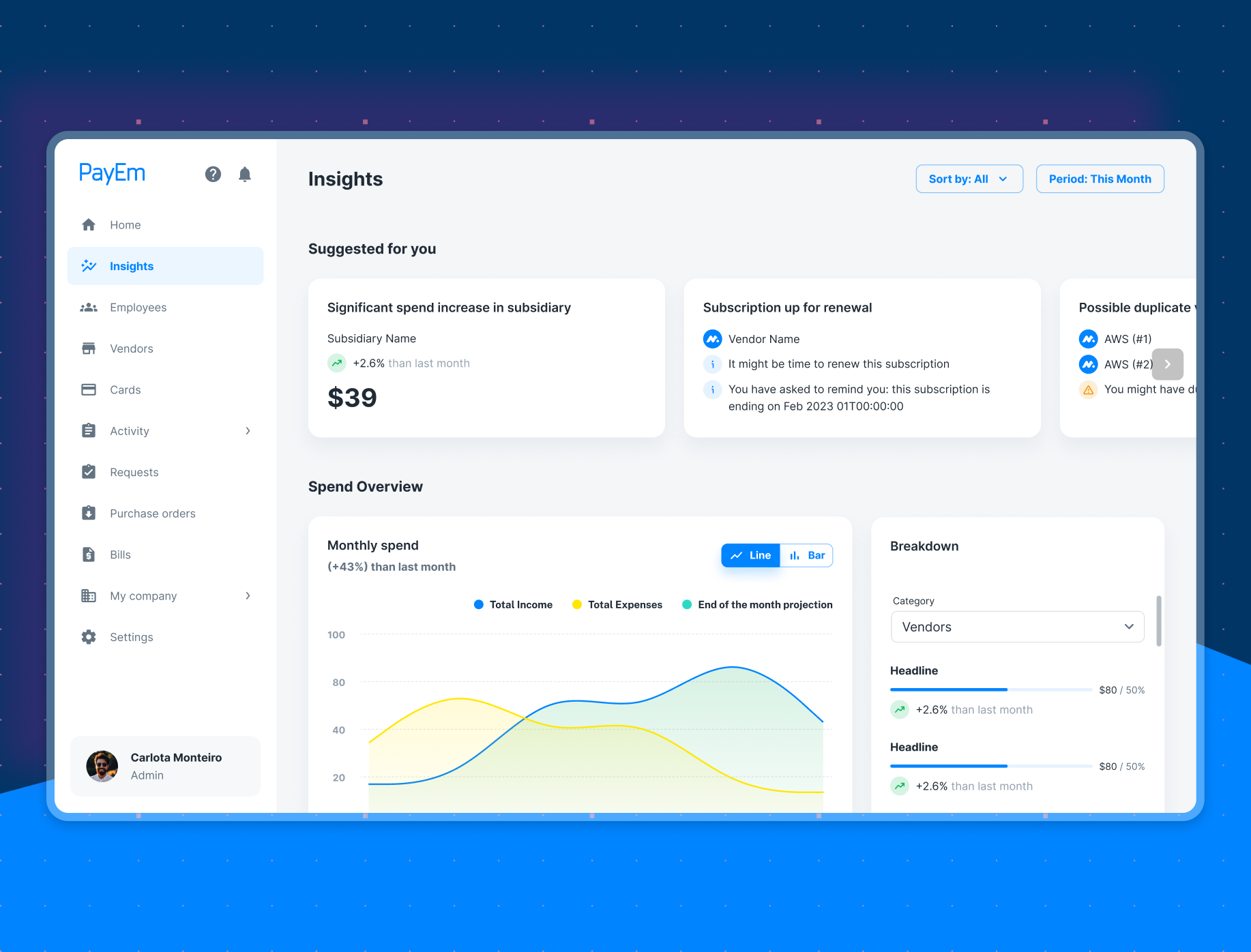

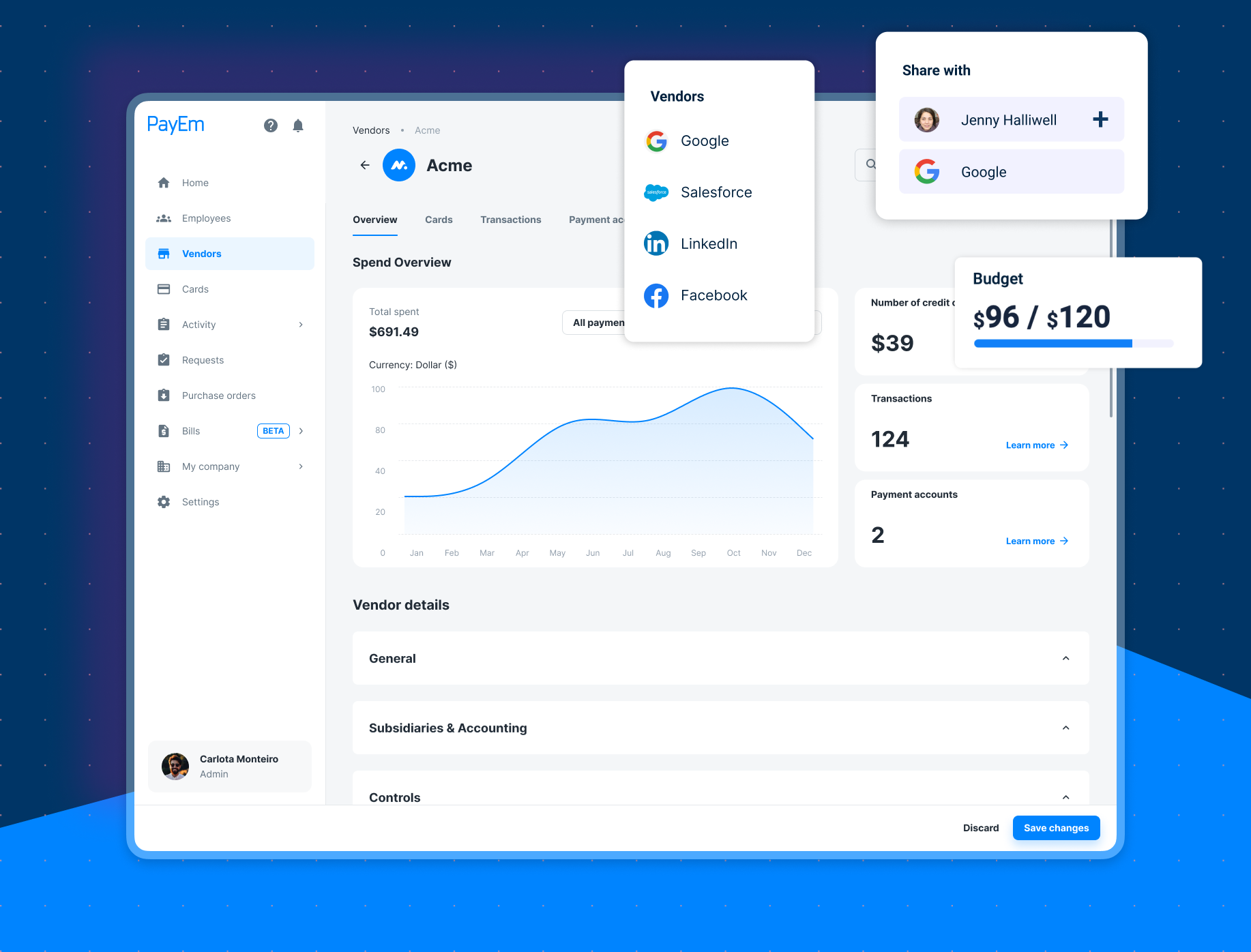

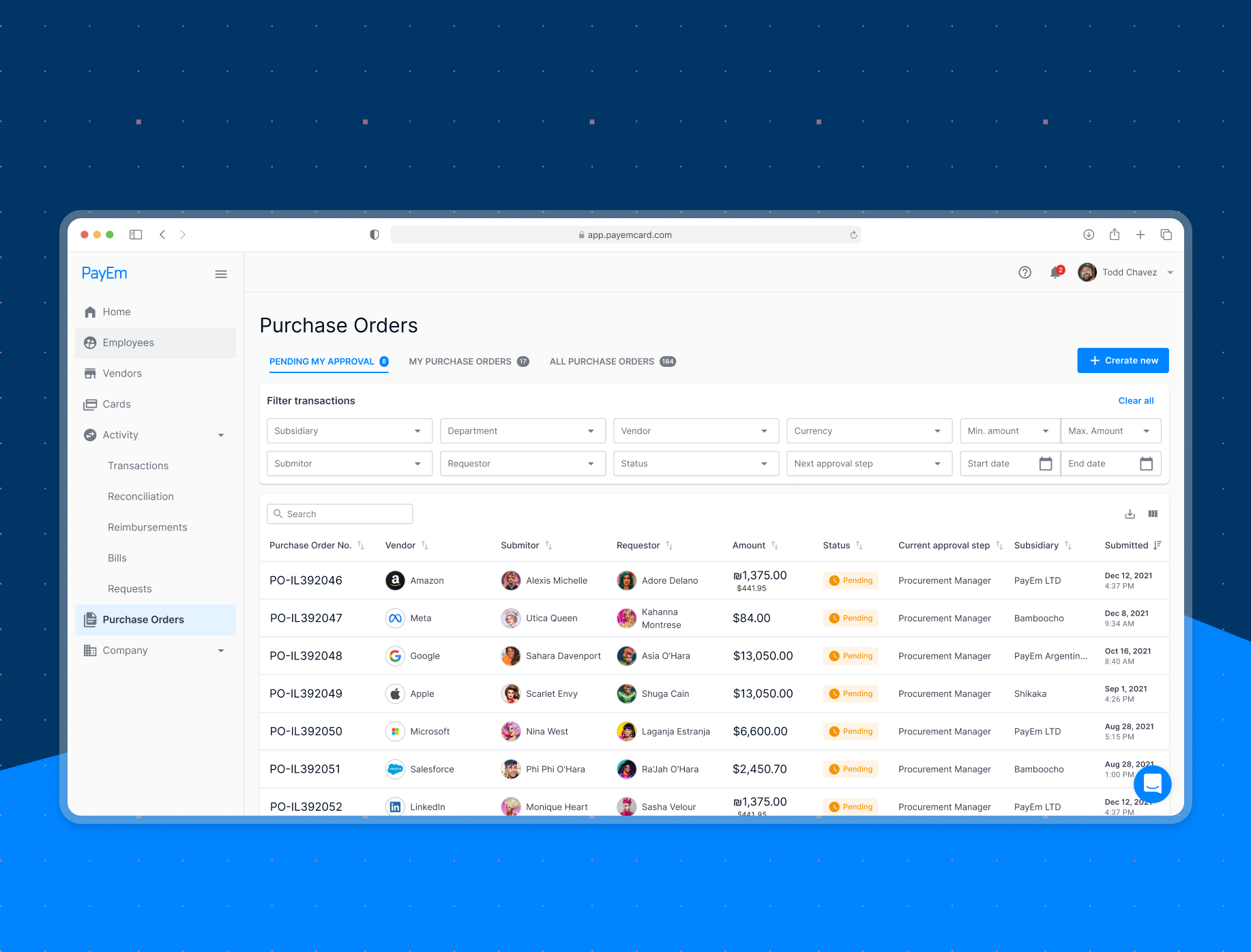

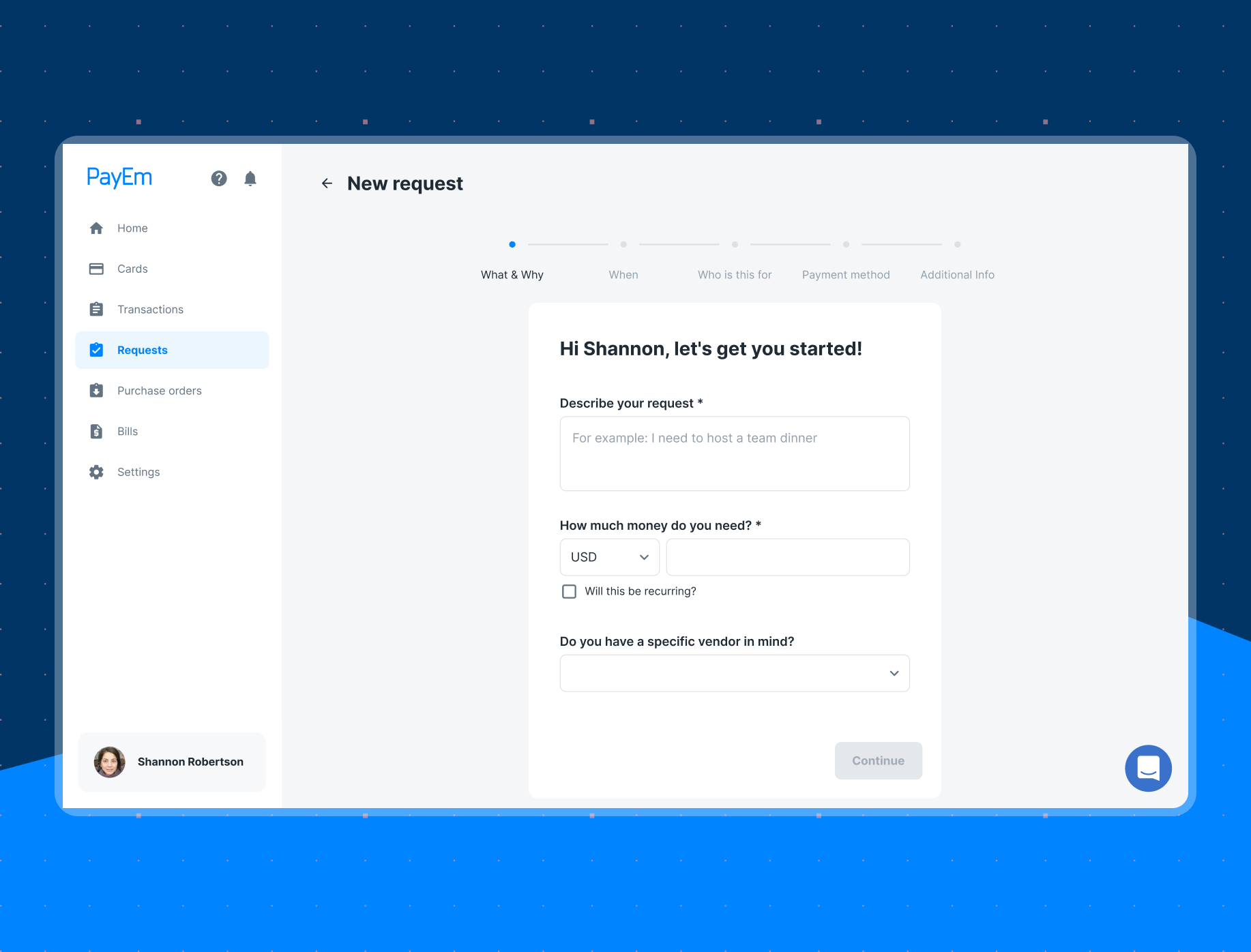

PayEm is a global spend & procurement platform that captures requests, invoices, creates bills, schedules and sends payments to anywhere in the world, in any currency. PayEm automates tedious tasks, giving finance teams precious time to focus on the big picture while giving them real-time visibility by department, team, employee, subsidiary, or vendor.

Images

Not sure about PayEm?

Compare with a popular alternative

Starting Price

Pricing Options

Features

Integrations

Ease of Use

Value for Money

Customer Service

Alternatives

Procurify

Tipalti

Spendesk

Expensify

Reviews

Already have PayEm?

Software buyers need your help! Product reviews help the rest of us make great decisions.

- Industry: Facilities Services

- Company size: 11–50 Employees

- Used Daily for 1+ year

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 10.0 /10

Easy Saas solution for vendor management funding and approval flow

Reviewed on 10/11/2021

We needed better expenditure management, budget management, and a clearer understanding how much we...

We needed better expenditure management, budget management, and a clearer understanding how much we spend on each vendor. PayEm has given me the ability to do budget tracking and troubleshooting on the spot. I’m in total control of the budget and can make sure that any deviation in the budget goes through me. At any given time. I know about the company’s expenses without going into outdated banking platforms. PayEm has also made it easy for employees to request funds. I no longer have to waste time with approval meetings. We easily avoid unnecessary credit card charges. The process is simple and convenient for everyone.

Pros

The robust purchase approval flow made our life easy. We can now receive requests from remote employees according to the company budget, manage all company vendor budgeting, and have a clear picture of all the money we manage, down to each and every transaction.

I have visibility of all the money coming out of the company at the supplier level making it easy to manage the budget.

Cons

There’s nothing to dislike. PayEm is a great value-add for customers.

- Industry: Education Management

- Company size: 51–200 Employees

- Used Daily for 6-12 months

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 10.0 /10

The only solution that serves both the finance department and all other departments in the...

Reviewed on 08/11/2021

Now, with PayEm if an employee leaves and forgets to close an account/subscription that charges...

Now, with PayEm if an employee leaves and forgets to close an account/subscription that charges every month, we can simply cancel that card, and the charges cease. Or, if a supplier attempts to charge more than we know is necessary, they're unable due to the settings we have defined for the card. There are no more credit card charges that we do not know who is responsible for. PayEm's SaaS and vendor management solution has truly made us more efficient.

Pros

I like the solution's efficiency: it allows the finance team to understand the owner and nature of each expense.

In addition, PayEm offers control: over the approved budget, real-time spend, the ability to block a charge in case of deviation from the budget on the spot (and not in retrospect), prevents cases of card breaches and unfamiliar charges, and allows users to attach the invoice/receipt themselves.

Cons

Not every business works with an American credit card - but PayEm is working to change this.

Also, the user experience can be improved, with slight changes that will make a big difference.

- Industry: Electrical/Electronic Manufacturing

- Company size: 51–200 Employees

- Used Daily for 6-12 months

-

Review Source

Overall rating

- Ease of Use

- Likelihood to recommend 7.0 /10

Nice product for credit-cards' based purchases

Reviewed on 15/10/2021

It's providing us the ability to let our employees use credit cards without depending on their...

It's providing us the ability to let our employees use credit cards without depending on their managers (by pre-approving limits /vendors) for each one individually if needed).

Pros

It's very easy to use, you can allocate each employee with its own credit card and monitor purchases / approval process.

Cons

Some suppliers are not accepting PayEm cards, which makes it difficult to rely on this service as the main solution.

- Industry: Computer Software

- Company size: 201–500 Employees

- Used Daily for 6-12 months

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 9.0 /10

PayEm centralizes all expenses in one place and offers control over the budget and credit card

Reviewed on 11/11/2021

One of the challenges for us is that we have several global subsidiaries. With PayEm we can manage...

One of the challenges for us is that we have several global subsidiaries. With PayEm we can manage the employee-level expenses incurred for companies from different countries in different currencies and associate everything to the correct department and the right budget item–all in one place. Even each card has a different billing address. Of course, every issue of transparency and control has saved us a lot of time, and we finally have more control.

Pros

I like the interface the most. The dashboard is simple, and the UI is clear. When we asked everyone who uses PayEm, they all said that the interface is easy and accessible. The finance team doesn’t have to waste time explaining anything; it’s easy to connect to the system and submit requests. On the main dashboard, I see the essential data that centralizes important data like balance, spend amount view for different categories, all pending and rejected requests. It helps me set priorities and handle tasks because I see both on the macro and micro levels.

Cons

On occasion, if I was unsure how to do something, all I need to do is talk to Customer Support, and they always help.

Alternatives Considered

Mesh Payments- Industry: Consumer Electronics

- Company size: 11–50 Employees

- Used Daily for 1+ year

-

Review Source

Overall rating

- Ease of Use

- Likelihood to recommend 9.0 /10

So much more than Saas spend management–PayEm is a true partner

Reviewed on 15/11/2021

Pros

There are many Saas spend management and business credit cards solutions, but PayEm truly stands out. They have an excellent customer success team, making them true partners and not just service providers. PayEm worked with us from day one to ensure everything is always running smoothly and cares about our business.

The platform UX is very easy to work with and understand. When I look at the numbers, I see the situation and what actions need to be taken. For example, I am in control using a vendor credit card because I can see every transaction, and I can know in real-time if I need to increase the budget or pay another way. PayEm's solution helps control our budget as well as our projection plan. The software helps me plan my budget for next year and understand how we plan monthly and annually. The main thing is the dialogue we have with CS, where we get feedback and get suggestions about the future and even increase the framework according to how we use it.

Cons

There’s nothing I dislike. Hope to see more products and features to use

PayEm FAQs

Below are some frequently asked questions for PayEm.Q. What type of pricing plans does PayEm offer?

PayEm offers the following pricing plans:

- Pricing model: Free Version, Subscription

- Free Trial: Not Available

Q. Who are the typical users of PayEm?

PayEm has the following typical customers:

11–50, 51–200, 201–500, 501–1,000

Q. What languages does PayEm support?

PayEm supports the following languages:

English

Q. Does PayEm support mobile devices?

PayEm supports the following devices:

Android (Mobile), iPhone (Mobile), iPad (Mobile)

Q. What other apps does PayEm integrate with?

PayEm integrates with the following applications:

AlexisHR, BambooHR, Charlie, ChartHop, Factorial, Freshteam, Gusto, HR Cloud, Justworks, Lano, Lucca, Namely, NetSuite, Paychex Flex, Paylocity, Personio, Proliant, Rippling, Sapling, Sesame, TriNet, TriNet Zenefits, Workday HCM, intelliHR

Q. What level of support does PayEm offer?

PayEm offers the following support options:

Email/Help Desk, FAQs/Forum, Knowledge Base, Chat

Related categories

See all software categories found for PayEm.