Buy now, pay later has become a popular e-Commerce payment method during the pandemic thanks to its convenience. Unlike traditional credit cards, retailers can receive instant payments. But is flexible payment a good thing for both merchants and consumers as Australia faces rising inflation rates?

In this article

Buy now, pay later (BNPL) services may seem like a good idea as a form of short-term financing so that consumers can purchase goods that they want or need, and pay for them later in instalments. But as global economies face rising interest rates and inflation, are flexible payments a good thing, or are they contributing to financial crisis and debt?

To find out more about buy now, pay later in Australia, we interviewed over 1,000 online shoppers to see whether they use the scheme, how they feel about it, and if they think BNPL should be regulated by law. The full methodology can be found at the bottom of this page.

How many Australian consumers use buy now, pay later companies?

BNPL is an online payment service that enables customers to purchase goods using (mostly) interest-free credit and pay for the items at a later date. Shoppers must usually complete the payment in around four instalments but can experience payment fee charges or higher interest rates if they are late when paying back the short-term loan.

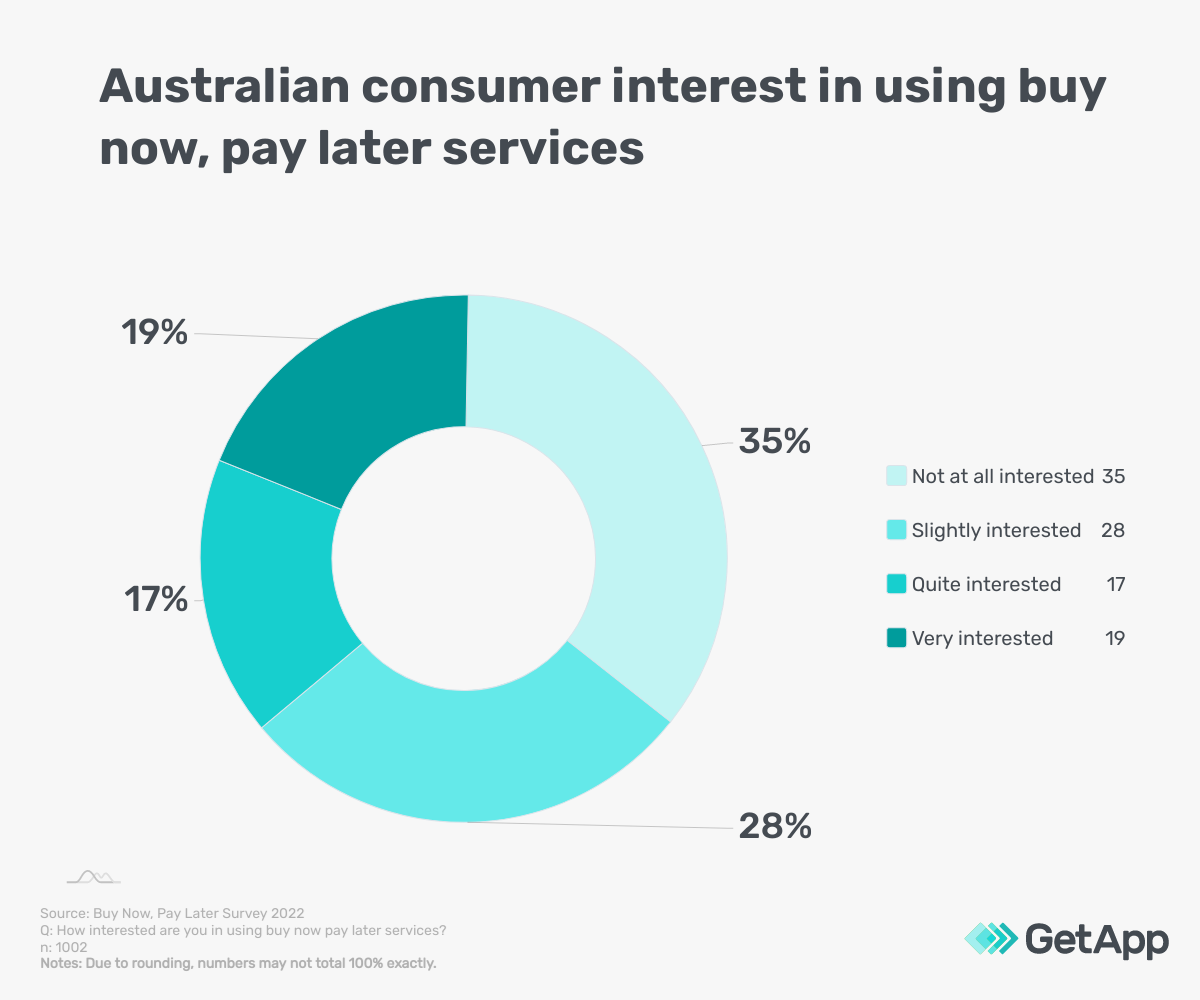

Buying popular goods or necessities and paying for them at a later date may sound appealing because it’s convenient and a way for customers to ‘try before they buy’. But how do Australian online consumers really feel about BNPL schemes? When asked if they were interested in using BNPL services, GetApp found a fairly sizeable group of survey-takers (35%) were ‘not at all interested’ in using the scheme. But a combined total of 65% were either ‘slightly’, ‘quite’, or ‘very interested’ in the payment service.

We found that spreading payments when shopping appeals to more than half of GetApp’s survey respondents, as 53% said they have used BNPL before whilst 47% have not. Out of those who have used it, Afterpay was the most commonly used provider for 83% of consumers we surveyed. This was followed by Zip Pay (37%), PayPal Pay in 4/ Pay in 3 (21%), Openpay (11%), and LatitudePay (11%).

Why do consumers like using BNPL services?

Although buy now, pay later companies, such as Afterpay and Klarna, have existed since the early 2010s, the increase in online shopping during the pandemic has catapulted these payment services into the e-Commerce marketplace. The rise in the use of mobile and social commerce has also played a part in their adoption as an online payment method.

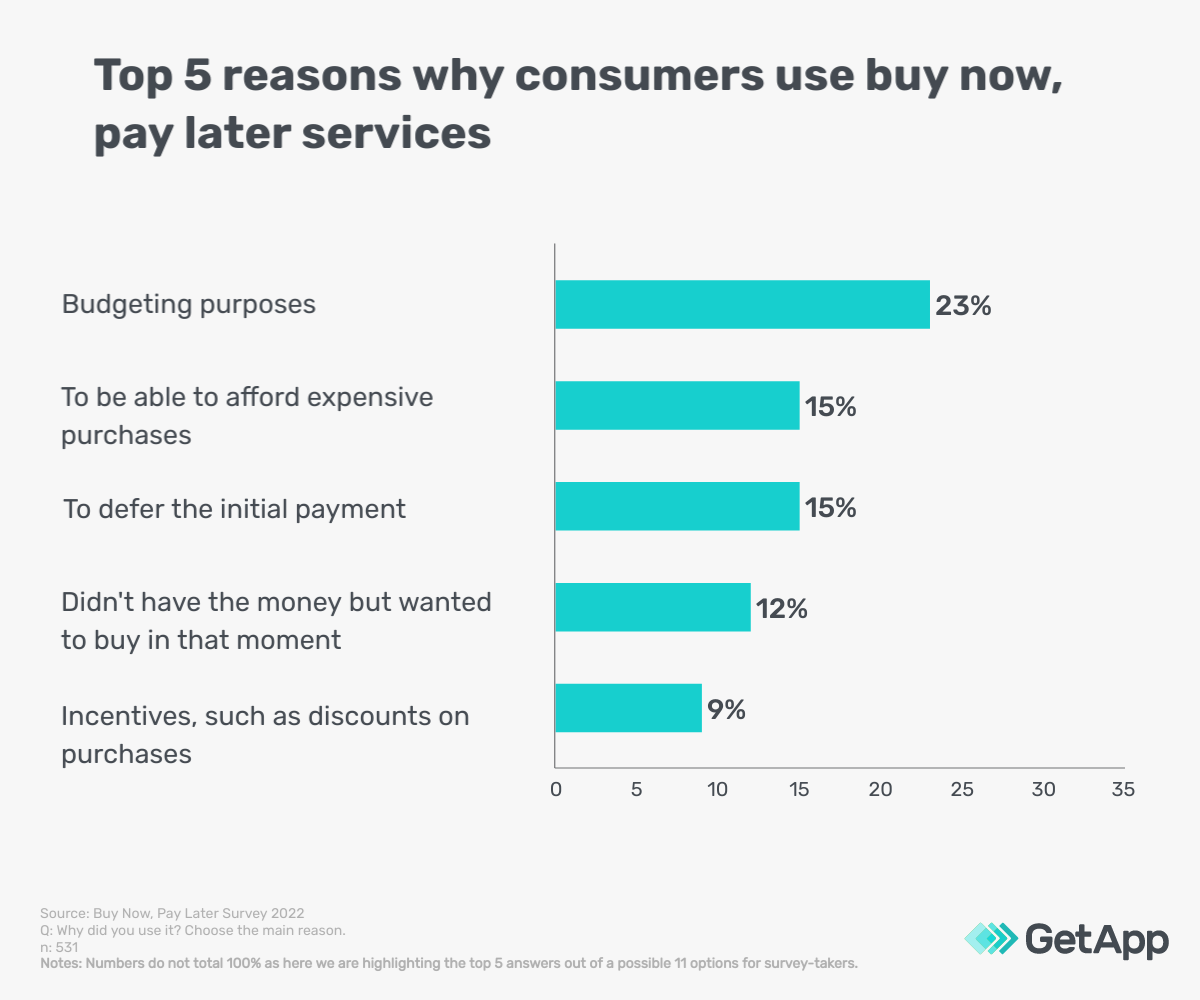

A combined total of 94% of survey-takers in the group who have used BNPL before, said they would use it again (55% said they would use it ‘on a regular basis’ and 39% would use it ‘in an emergency’). But what is the appeal of using the scheme? According to nearly a quarter (23%) of online shoppers surveyed, ‘budgeting purposes’ is the main reason they used BNPL.

Purchasing ‘fashion, clothes, and shoes’ (57%) is the most common type of product consumers used BNPL services for when shopping online. This was followed by:

- Home goods/furniture (42%)

- Electronics (video games, software, hardware, etc.) (34%)

- Beauty and cosmetics (31%)

- Entertainment (23%)

Did you know?

GetApp’s previous article on online payment methods and consumer concerns found that customers like variety when it comes to making online purchases.

Payment processing tools enable e-Commerce sites to offer multiple digital payment options, including bank cards (credit and debit), digital wallets (such as PayPal, Apple Pay, or Stripe), BNPL providers, mobile banking, or digital currency.

Offering customers multiple payment options may help to retain existing customers, attract new ones, may positively impact sales increase, and see return buyers.

What are the downsides of BNPL, according to users?

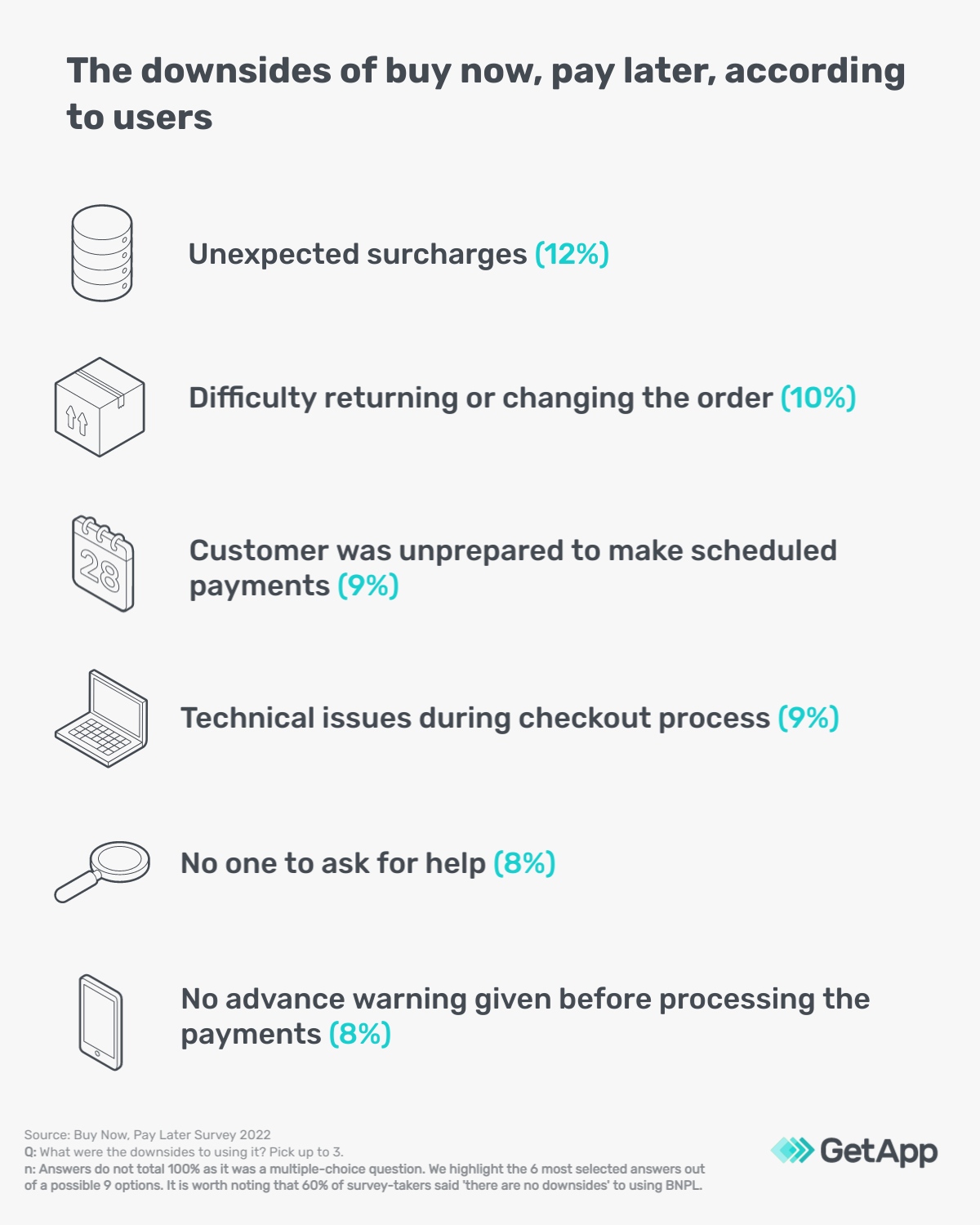

We asked survey-takers who have used BNPL services before to share what they thought to be the downsides of the service. The most common downsides included unexpected surcharges (12%), difficulty returning or changing the order (10%), and being unprepared to make the scheduled payments (9%). It is worth noting that 60% of users said there were no downsides.

Currently, Australian consumers are having to tighten their budgets with high energy and house prices. But even if they continue using BNPL services, there is always the risk that many consumers may not be able to maintain payments or pay off their debt during these hard times.

However, at the time of running our survey, we found that only 10% of respondents had failed to pay their BNPL purchases back on time. 85% of people within this small group said they had a late payment fee as a consequence. 35% of survey-takers said they were unable to make further purchases as a result, and a quarter (25%) of consumers said they were given a warning.

Why are some online shoppers uninterested in using BNPL?

GetApp’s survey found the main reason why some consumers are not using BNPL is that they prefer using more familiar services, such as a credit or debit card, or PayPal. This was according to 37% of respondents in our survey who have never used BNPL before. The second biggest reason is that they are worried about getting into debt (23%), followed by being afraid to spend more money than they have (10%).

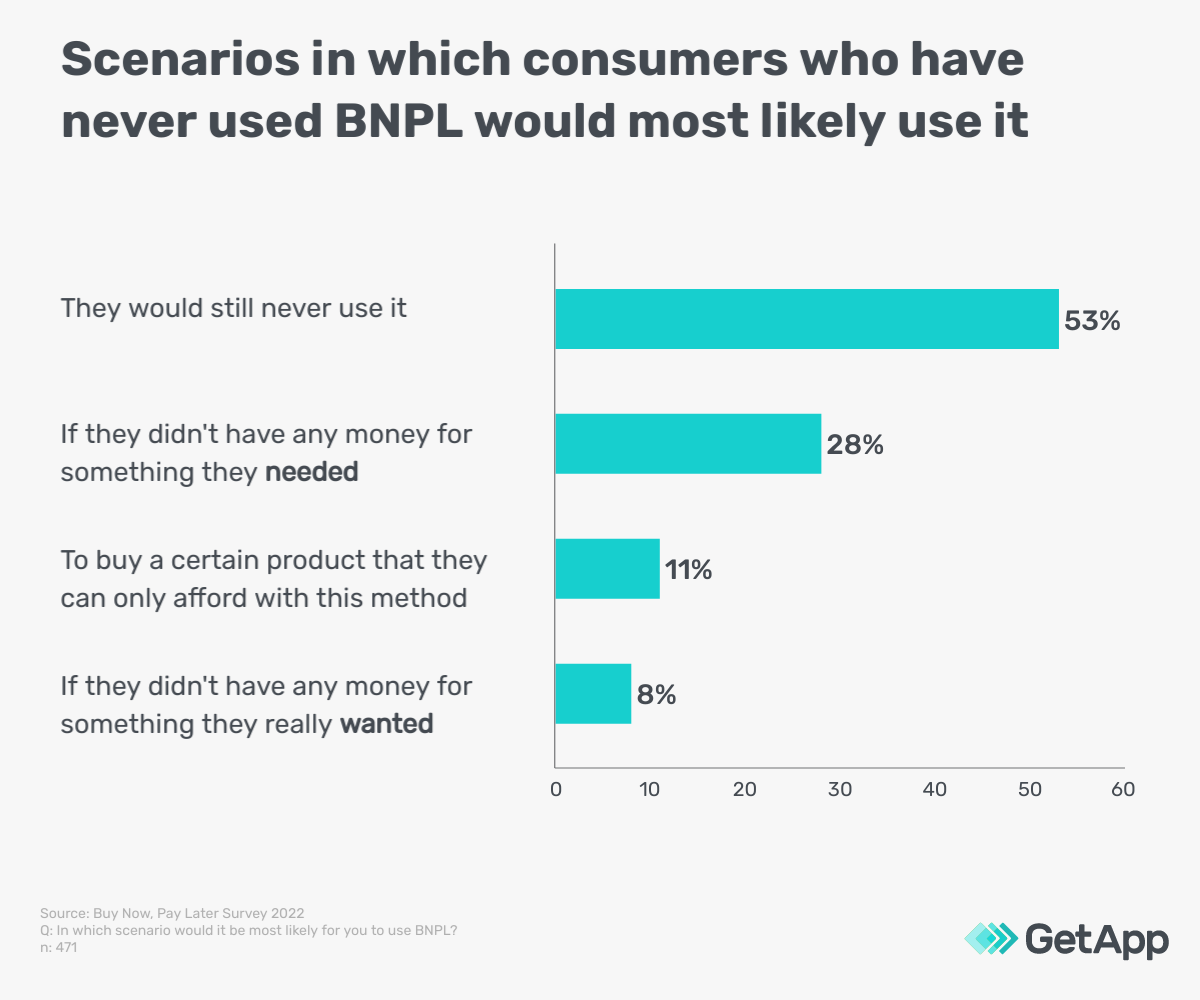

When asked under which circumstance they may use BNPL, 53% of survey-takers in the group of people who haven’t used it before were still insistent that they never would. 28% of people said they would use it if they didn’t have money for something that they needed.

Analysis of the BNPL industry

Research highlights that the global BNPL market will reach $US 3.98 trillion by 2030. However, early 2022 has seen some BNPL companies on the verge of collapse due to the cost of living pressures rising for Aussies. As a way to overcome the threat of collapse, some Australian BNPL companies have merged with larger entities.

Afterpay, for example, joined with US-based payment platform Square (Block, Inc.), which is run by Twitter founder Jack Dorsey. Three months after the acquisition, Square integrated Afterpay for in-person shopping in the US and Australia, meaning that BNPL is now available across online and in-person commerce. Shoppers can use Afterpay as a mobile wallet, containing their virtual Afterpay card at the point of sale. The integration of the two products highlights how both businesses are helping one another grow in the fintech marketplace.

When deciding on which provider to use, it is important to evaluate the company’s:

- Track record of transaction processing

- Risk prevention strategy against fraudulent transactions

- Investments in data security (to protect against hacking)

- Implementation requirements

- Approval rates

- Cost considerations (merchant fees)

- Financial stability

Is buy now, pay later regulated in Australia?

Currently, in Australia, BNPL providers are not regulated under consumer credit laws (The National Consumer Credit Protection Act 2009 and the National Credit Code). But a significant number of BNPL companies follow an industry code of conduct (the AFIA BNPL Code of Practice) and the product also falls under The Corporations Act 2001.

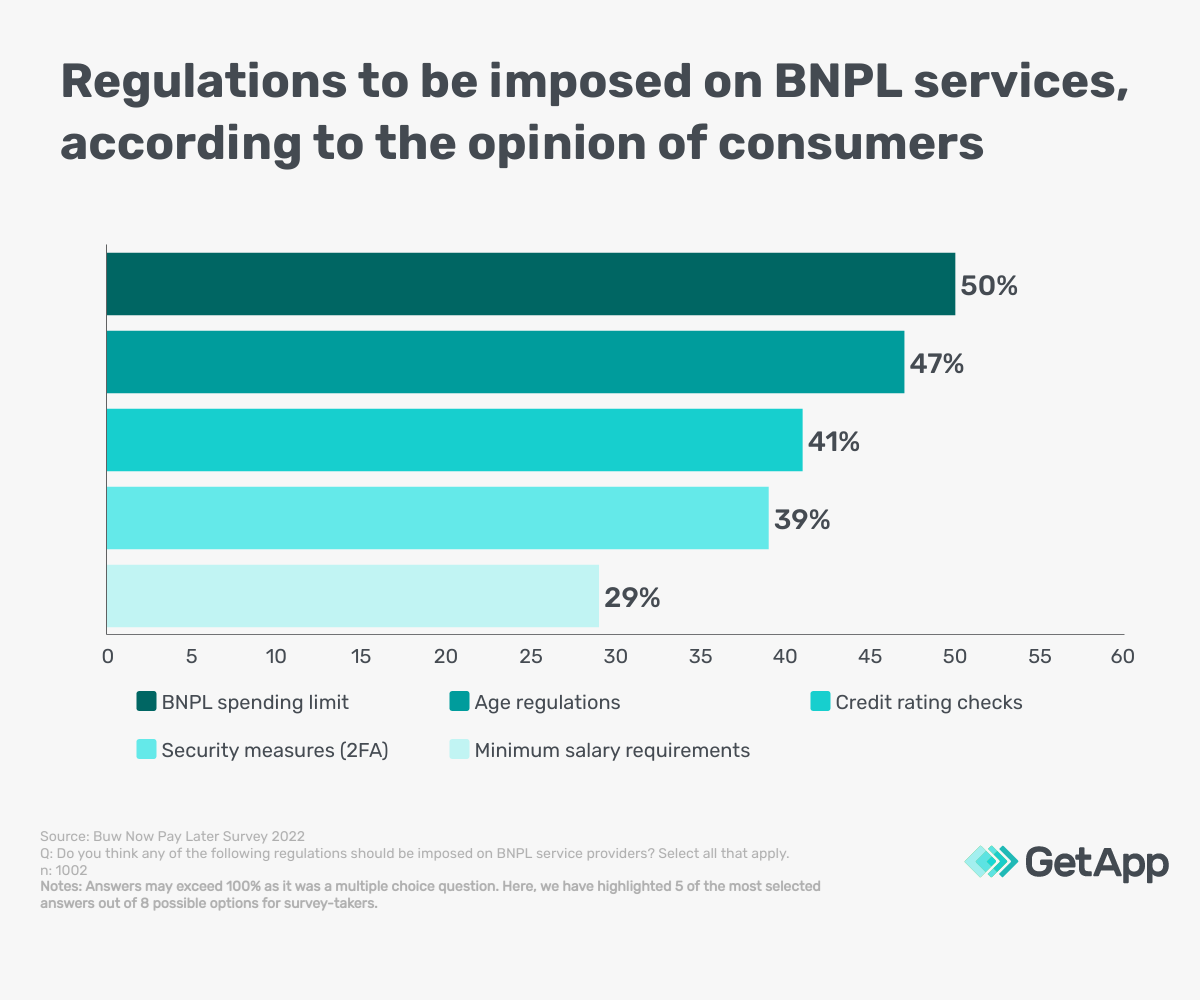

As BNPL remains fairly unregulated, customers are not necessarily being fully monitored and could use more than one provider at once. GetApp gave survey respondents a list of possible regulations and asked whether they believed these should be imposed on BNPL service providers. Imposing a ‘BNPL spending limit’ (50%) was the most common answer selected by consumers, closely followed by ‘age regulations’ (47%), and ‘credit rating checks’ (41%). It seems like respondents recognise that regulators need to have more insight into the debt that is arising from BNPL.

An important question to ask is whether Australian shoppers trust BNPL services. 73% of survey-takers are of the opinion that BNPL services are trustworthy (17% of people said ‘trustworthy’ and 56% said ‘somewhat trustworthy’). Just over a quarter of respondents (27%) find BNPL services to be untrustworthy (20% of consumers answered ‘not very trustworthy’ and 7% said ‘not at all’).

- Appeal to your consumer target demographic

- Clearly outline the terms and conditions

- Offer an omnichannel consumer experience (both online and in-store options)

- Ensure customers use data security practices, such as multi-factor authentication

- Have customer service representatives on hand via live chat for any queries

- Provide rewards and loyalty management programs

Buy now, pay later has become an important marketing tool for retailers. The point of sales financing is relatively easy for merchants to manage. However, it is important for retailers to do their research before entrusting a provider, taking into account what is important for their consumer’s needs and which Australian BNPL provider looks to be financially stable in the marketplace.

Methodology

To collect data for this report, GetApp conducted an online survey in April 2022. Of the total participants, we were able to identify 1,002 respondents who fit the following criteria:

- Australian residents

- Aged over 18 years old and under 75 years old

- Employed by a company with under 250 employees

- Shop online at least once every month