Square Payments

About Square Payments

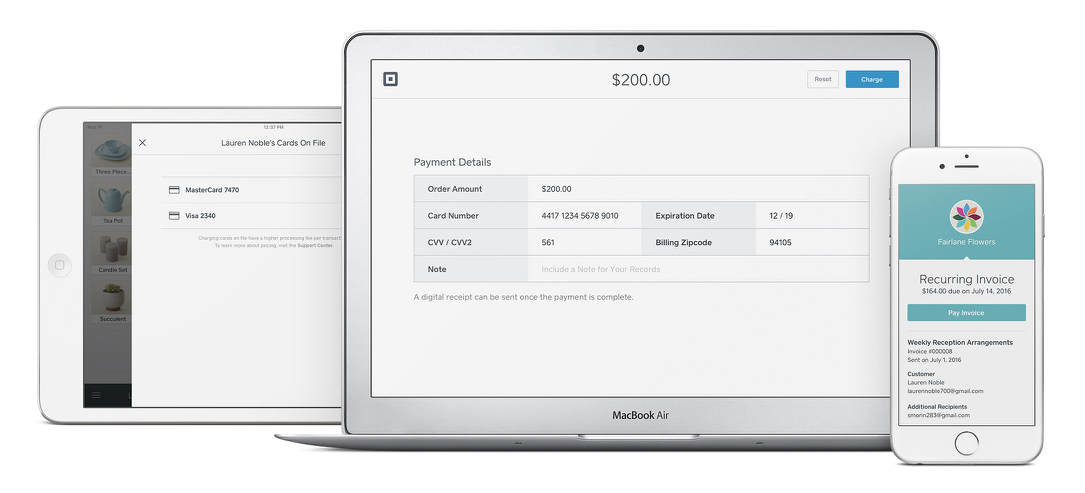

Square Payments is an online payment processing solution which integrates with Square hardware and POS software to allow businesses to accept various payment types. Businesses can use Square Payments to make transactions from any location, deposit payments from all major credit cards, send invoices, store payment details for recurring customers, sell through e-commerce platforms, and more through integration with other Square tools and third party applications.

In order to facilitate the acceptance of any type of payment, Square Payments provides tools for managing chip cards, NFC payments, magstripe, remote payments, cash deposits, and more, meaning businesses can offer more flexibility to their customers. Users can integrate with Square’s card reader hardware and POS application to process payments anywhere, and in any way that customers wish to pay. Payments can also be handled remotely by keying in payments even when offline and, utilizing Square hardware, merchants can accept credit cards, NFC payments, gift cards, and more.

Square Payments provides automatic security measures including PCI compliance, chargeback protection, account takeover protection, fraud monitoring and detection, and more, so that both businesses and their customers can rest assured their accounts and data are safe when completing transactions.

Pricing starting from:

USD 0.01

- Free Version

- Free Trial

- Subscription

Key benefits of Square Payments

Typical Customers

- Freelancers

- Small Businesses (2-50)

- Mid-size Companies (51-500)

- Large enterprises (500 and more)

Deployment

- Cloud-based

- On-premises

Supported Languages

English, French, Japanese, Spanish

Pricing starting from:

USD 0.01

- Free Version

- Free Trial

- Subscription

Images

Features

Total features of Square Payments: 33

Alternatives

ProPay

Slice

Salesforce Sales Cloud

Plooto

Reviews

Already have Square Payments?

Software buyers need your help! Product reviews help the rest of us make great decisions.

- Industry: Consumer Goods

- Company size: Self Employed

- Used Weekly for 6-12 months

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 10.0 /10

Amazing products and software!

Reviewed on 21/11/2024

Square Payments is a super easy software that allows you to take card payments and not have to...

Square Payments is a super easy software that allows you to take card payments and not have to always request cash. I find that the mini card reader makes it easy to travel to various bake sales, farmers markets, etc and accept payments with ease.

Pros

I love that Square Payments sent me a free card reader to attach to my charging port. This was super convenient as I am starting up my baking business and do not have to rely on getting cash.

Cons

I have not found a con for Square Payments yet, everything has been wonderful.

- Industry: Apparel & Fashion

- Company size: Self Employed

- Used Monthly for 2+ years

-

Review Source

Overall rating

- Ease of Use

- Likelihood to recommend 8.0 /10

Square is a great alternative to over-priced and over-complicated alternatives

Reviewed on 04/11/2024

I only had to use it a few times for receiving payments from customers, but it was easy and...

I only had to use it a few times for receiving payments from customers, but it was easy and convenient

Pros

Square Payments is easy to set-up and use. The fees are quite low, there are no monthly charges or cancellation fees.

Cons

It is sometimes difficult to get a credit or debit card to read/scan.

Alternatives Considered

StripeReasons for Switching to Square Payments

I chose Square over other alternatives at the time, because the fees were low, there are no monthly fees, no cancellation fees, and I can use it or not use it as my customer demand required.- Industry: Consumer Services

- Company size: 11–50 Employees

- Used Weekly for 6-12 months

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 6.0 /10

Square payment processing

Reviewed on 03/10/2024

Pros

Once they deliver the hardware payments become so easy with every customer

Cons

Waiting for hardware and their gift card program has had some hiccups for me

- Industry: Arts & Crafts

- Company size: Self Employed

- Used Weekly for 1+ year

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 5.0 /10

it is ok to Start it open your business

Reviewed on 13/08/2024

Its user-friendly interface and straightforward payment process have made managing transactions...

Its user-friendly interface and straightforward payment process have made managing transactions much easier. While the fees are higher compared to other options, it’s a solid choice if you don’t have other alternatives. Its popularity and reliability make it a trustworthy option.

Pros

I have been using it and it has been incredibly convenient for both online and offline transactions. The platform allows me to receive payments from clients seamlessly, without the hassle of complicated options. Its user-friendly interface and straightforward payment process have made managing transactions much easier.

Cons

the fees are higher compared to other options, which is a significant drawback. After a few years, I switched to Venmo for a more cost-effective solution.

- Industry: Accounting

- Company size: 2–10 Employees

- Used Monthly for 2+ years

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 9.0 /10

Good Software but reports could be better

Reviewed on 07/11/2024

The payment fees are competitive with comparable programs.

The payment fees are competitive with comparable programs.

Pros

It is easy to set up and use. Can be used with a cellphone.

Cons

The report features. Sales tax report does not include totals.

Alternatives Considered

StripeReasons for Switching to Square Payments

The cost and ease of use online store nice featureSquare Payments FAQs

Below are some frequently asked questions for Square Payments.Q. What type of pricing plans does Square Payments offer?

Square Payments offers the following pricing plans:

- Starting from: USD 0.01

- Pricing model: Free Version

- Free Trial: Not Available

Per swipe/dip/tap: 2.6% + $.10 Keyed in: 3.5% + $.15 per transaction Online & invoices: 2.9% + $.30 per transaction Custom pricing packages are also available. Contact Square for more information.

Q. Who are the typical users of Square Payments?

Square Payments has the following typical customers:

Self Employed, 2–10, 11–50, 51–200, 201–500, 501–1,000, 1,001–5,000

Q. What languages does Square Payments support?

Square Payments supports the following languages:

English, French, Japanese, Spanish

Q. Does Square Payments support mobile devices?

Square Payments supports the following devices:

Android (Mobile), iPhone (Mobile), iPad (Mobile)

Q. What other apps does Square Payments integrate with?

Square Payments integrates with the following applications:

Acuity Scheduling, BigCommerce, Craver, DAVO, Ecwid, Fomo, Linktree, Mailchimp, Make, MarginEdge, MoeGo, Paymo, Poptin, QuickBooks Online Advanced, Sociavore, Square Invoices, Square Point of Sale, Synder, Thrive by Shopventory, TouchBistro, Weebly, Wix, WooCommerce, Zoho Invoice

Q. What level of support does Square Payments offer?

Square Payments offers the following support options:

Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, Chat

Related categories

See all software categories found for Square Payments.