Flutterwave

About Flutterwave

Flutterwave is a comprehensive payment platform that unlocks boundless opportunities for enterprises, individuals, small businesses, emerging markets, and startups alike. With its global reach and extensive capabilities, Flutterwave empowers businesses and individuals to seamlessly accept payments, send money, build financial products, and leverage a suite of business tools designed to drive growth.

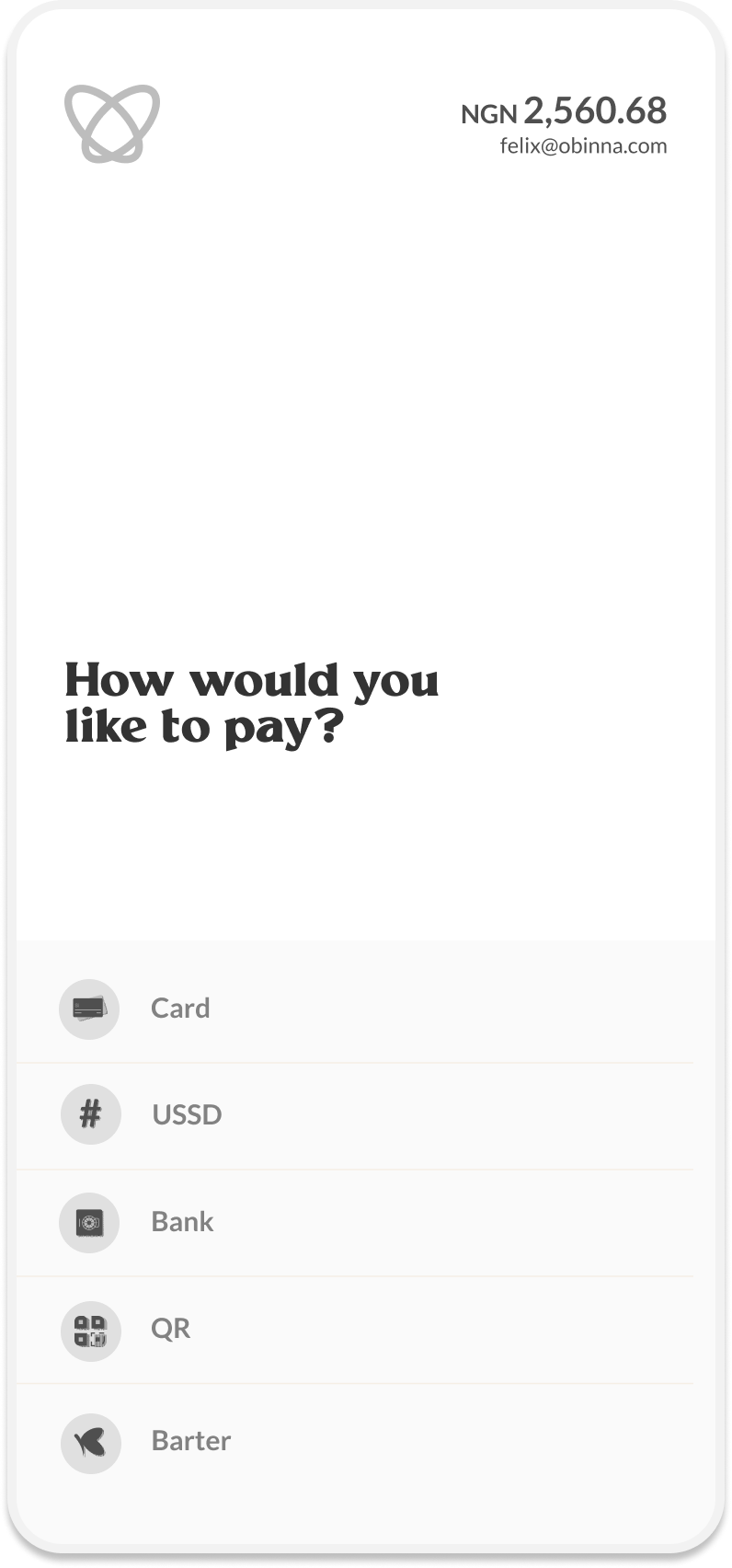

The platform supports over 30 currencies and offers a wide range of payment methods, including debit/credit cards, bank accounts, mobile money, POS, and more. Flutterwave's well-documented and easy-to-use APIs enable developers to quickly integrate core payments functionalities, facilitating frictionless transactions and enhanced customer experiences. Trusted by 1 million businesses and 2 million individuals, the platform processes an average of 500,000 payments daily, with API calls peaking at 231 requests per second.

For enterprises, Flutterwave provides a smart online checkout system with incredible speed and simplicity, enabling businesses to easily receive payments from around the world. The platform also facilitates effortless cross-border payouts and transfers, as well as point-of-sale solutions to support physical business growth. Small and medium-sized enterprises can leverage Flutterwave's suite of tools, including online stores, payment links, invoicing, and specialized services for creators and event organizers. Individuals can also benefit from Flutterwave's personal solutions, such as the Send app for secure money transfers, the Market for online shopping, and the Afritickets platform for event ticketing.

Key benefits of Flutterwave

Accept payments online from anywhere in the world in 30+ currencies

Make quick and easy cross-border transfers and payouts

Sell online globally with no code ecommerce solutions

Grow your physical business with POS systems

Seamlessly send money abroad to loved ones

Images

Not sure about Flutterwave?

Compare with a popular alternative

Starting Price

Pricing Options

Features

Integrations

Ease of Use

Value for Money

Customer Service

Alternatives

Stripe

Tipalti

Paystack

PayPal

Reviews

Already have Flutterwave?

Software buyers need your help! Product reviews help the rest of us make great decisions.

- Industry: Architecture & Planning

- Company size: 2–10 Employees

- Used Daily for 2+ years

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 7.0 /10

Best Payment Gateway with PayPal

Reviewed on 29/04/2023

Using flutterwave for over 3years now has been good so far.

Using flutterwave for over 3years now has been good so far.

Pros

My company uses Flutterwave to create payment links for customers so as to enable them pay however they want. I personally like the fact that they integrated Paypal because most of our foreign clients prefer it. At a point, they stopped offering the PayPal payment option to all vendors and limited it to just registered businesses. As a result, we were forced to register our business with CAC and become a legal entity. Thanks to flutterwave and their seamless payment options.

Cons

Apart from delayed response from customer service at times, I think they should also consider reducing the number of days for dollar payouts.

- Industry: Computer Software

- Company size: 51–200 Employees

- Used Daily for 2+ years

-

Review Source

Overall rating

- Ease of Use

- Customer Support

- Likelihood to recommend 7.0 /10

Best payment gateway for Africans

Reviewed on 09/04/2023

Pros

Rave is very easy to set up and use. It also integrates many African mobile payment methods like orange money, MTN mobile money, express union, and even credit cards.

Cons

There are a lot of failed transactions recorded within my period of use. They upgraded to a be dashboard that was not mobile responsive and did not really look good to me as compared to v2.

Reasons for Switching to Flutterwave

It's the only one of these that has mobile money for MTN and ORANGE in Cameroon.- Industry: Computer Software

- Company size: 51–200 Employees

- Used Monthly for 2+ years

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 6.0 /10

Flutterwave payment processor

Reviewed on 23/11/2022

Pros

Flutterwave has a very easy to navigate through dashboard. It takes very few steps to implement. Works well with mobile money.

Cons

They easily go against their own terms and policies. Flutterwave has a continuous record of failed transactions due to one reason or the other.

- Industry: E-Learning

- Company size: 2–10 Employees

- Used Daily for 6-12 months

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 10.0 /10

RAVE by FLUTTERWAVE; WORTH IT OR NOT

Reviewed on 07/05/2022

Now I can receive payments from my customers directly from their cards. This makes transactions on...

Now I can receive payments from my customers directly from their cards. This makes transactions on my website seamless and I’ve seen an increase in sales as a result of integrating RAVE into my platform. Prior to RAVE, integrating payment gateways into my platform used to be a challenge because the giant payment gateways like Stripe and PayPal don’t allow users from certain regions which my country is a part of.

Pros

It allows one to receive payments online from customers' cards directly on their websites even though the business is yet unregistered.

Prior to RAVE, I was using PayStack, which was great until they dropped support for businesses who weren’t registered with the government at the time. I had to switch to RAVE so that by business could continue while I underwent registration. Since then, I haven’t looked back.

Cons

While I believe RAVE is a great product, I think they could improve with respect to direct integration with other common and mostly used platforms without needing integration softwares like zapier for instance. For example, even though I integrated RAVE into my LMS with the use of Zapier, its difficult to run affiliate marketing on my platform directly because RAVE isn’t the default LMS payment gateway. Much could be done on this.

- Industry: Consumer Goods

- Company size: 2–10 Employees

- Used Daily for 1-5 months

-

Review Source

Overall rating

- Ease of Use

- Customer Support

- Likelihood to recommend 8.0 /10

Rave by Flutterwave for payments to African e commerce shops

Reviewed on 20/10/2023

I am certainly solving the problem of receiving payments for goods in Africa by using Rave/Flutterwa...

I am certainly solving the problem of receiving payments for goods in Africa by using Rave/Flutterwave.

Pros

Paypal/Payoneer and some of the other big names do not allow e-commerce stores to get payments. Flutterwave does.

Cons

It did take a long time and was quite cumbersome to set up but after the initial frustration, it worked well.

Flutterwave FAQs

Below are some frequently asked questions for Flutterwave.Q. What type of pricing plans does Flutterwave offer?

Flutterwave offers the following pricing plans:

- Free Trial: Not Available

Q. Who are the typical users of Flutterwave?

Flutterwave has the following typical customers:

2–10, 11–50, 51–200

Q. What languages does Flutterwave support?

Flutterwave supports the following languages:

English

Q. Does Flutterwave support mobile devices?

Flutterwave supports the following devices:

Q. What other apps does Flutterwave integrate with?

We do not have any information about what integrations Flutterwave has

Q. What level of support does Flutterwave offer?

We do not have any information about what support options Flutterwave has

Related categories

See all software categories found for Flutterwave.