Stripe

About Stripe

Stripe is an online payment processing tool for internet businesses. Whether managing a subscription service, an on-demand marketplace, an e-commerce store, or a crowdfunding platform, Stripe’s meticulously designed APIs and functionality help users create the best possible product for their users.

Stripe allows users to bill customers on a recurring basis, set up a marketplace, or simply accept payments using its fully integrated, global payments platform. Developers are able to rapidly build production-ready integrations with modern tools, from React components to real-time webhooks. Using Stripe’s developer platform means less maintenance for legacy systems and more focus on core customer and product experiences.

Organizations can accept all major debit and credit card payments in 135+ currencies. If needed, enable 3D Secure for any payment. Stripe supports more than just cards using global payment methods, which can be activated from the dashboard including ACH credit transfers, Alipay, Bancontact, Giropay, and more.

Stripe’s elegant abstractions simplify adding or changing billing models, including a powerful interface to test and roll out new pricing easily. Users can bill customers with one-off invoices or automatically on a recurring basis. Go global with support for different payment methods. The Stripe billing API is easy to integrate into existing websites, mobile apps, or even CRM systems. Developers can use out-of-the-box functionality to get started quickly or use our composable API building blocks to design fully customized subscription logic and pricing models.

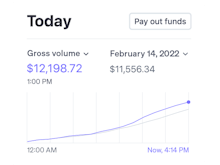

Users can create and manage subscriptions and invoices—and view detailed financial reports—directly from the dashboard. Stripe doesn’t limit the number of team members that can be added and supports granular roles and permissions to help manage access.

Connect, Stripe's routing and payout engine, will automatically track balances, batch earnings into payouts, time transfers with local cutoffs, and retry failed transfers. Users can also incorporate advanced flows like account debits, one-to-many payments, and others. Connect’s payout engine lets users specify payout timing for users, and includes instant payouts, which allows users to receive funds within minutes. Connect helps get recipients paid faster and removes errors and reconciliation work.

Pricing starting from:

USD 0.30

- Free Version

- Free Trial

- Subscription

Key benefits of Stripe

Typical Customers

- Freelancers

- Small Businesses (2-50)

- Mid-size Companies (51-500)

- Large enterprises (500 and more)

Deployment

- Cloud-based

- On-premises

Pricing starting from:

USD 0.30

- Free Version

- Free Trial

- Subscription

Images

Features

Total features of Stripe: 35

Alternatives

Revolut Business

QuickBooks Money

Pushpay

Mollie

Reviews

Already have Stripe?

Software buyers need your help! Product reviews help the rest of us make great decisions.

- Industry: Marketing & Advertising

- Company size: 2–10 Employees

- Used Monthly for 2+ years

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Likelihood to recommend 9.0 /10

It simply does the job.

Reviewed on 24/07/2023

The fees are basically the same across the board with the various payment processors.

The fees are basically the same across the board with the various payment processors.

Pros

Stripe is easy to get up and going with. It is geared toward developers, which was helpful for me.

Cons

The invoicing feature seems like an afterthought compared to some of the other features, even though that's one of the primary features I use. It still gets the job done, but it's a little cumbersome to get started with.

Alternatives Considered

PayPal InvoicingReasons for Switching to Stripe

Stripes developer documentation seems more polished and "up to date". PayPal's documentation was not as intuitive to find appropriate answers.- Industry: Automotive

- Company size: 2–10 Employees

- Used Monthly for 6-12 months

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 8.0 /10

Endless possibilities, quick to implement, and great with integrations, but at a cost

Reviewed on 09/07/2024

Stripe works very well, it's not free, and the fees stack up quite quickly, especially if you're...

Stripe works very well, it's not free, and the fees stack up quite quickly, especially if you're selling internationally. However, I think it's such a complete platform and setting up everything is free, that it's worth the cost of transactions.

We mainly use it with low-code solutions such as Bubble.io. The documentation and support is excellent. Also, should you expand to full code, the documentation is so complete that's always a safe bet.

It does the job, it's a "set-it-and-forget-it" product great for starting with very low budget, and scales tremendously well as you grow.

Pros

We work a lot with no code, especially with Bubble.io apps. I've had the chance to integrate Stripe on various project and the speed of implementations, support and seamlessness is really what makes this solution stand out.

The user portal in which you can create your products, set up discount codes and coupons, personalize subscriptions etc. is really useful and it allows to set up your shop in a few hours.

We mainly use it for SAAS subscriptions and we've never had any problem with payments, processing speed or process clarity.

Cons

Although setting up and starting out is free, the credit card commissions, exchange commissions and service for processing are quite high. Stripe eats a noticeable amount in fees, but still, it saves you so much time during the implementation and payment setup. As a startup it is really important to act quickly and have "set it and forget it" solutions for your infrastructure

Alternatives Considered

ShopifyReasons for Switching to Stripe

Easy to integrate with Bubble.io apps, that are our main focus.- Industry: Photography

- Company size: Self Employed

- Used Weekly for 1-5 months

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 5.0 /10

Stripe review

Reviewed on 15/11/2024

My overall experience with Stripe is positive but not really standout, I’ll be continuing use of...

My overall experience with Stripe is positive but not really standout, I’ll be continuing use of the program

Pros

What I liked most about stripe is it’s compatibility with many online marketplaces

Cons

What I liked least about stripe is it’s weak layout when compared to its competitors

- Industry: Automotive

- Company size: 2–10 Employees

- Used Daily for 1+ year

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 0.0 /10

Fraud prevention is important!

Reviewed on 18/07/2024

Not at all good. After my issue with transaction fraud, I could not speak to customer service. It’s...

Not at all good. After my issue with transaction fraud, I could not speak to customer service. It’s virtually impossible to get someone on the phone or just get help in general as a small business owner.

Pros

The ease of use, there are times when I can’t talk on the phone with a customer because I had one with me in person. I could send them to my website to make their payment and it would process immediately.

Cons

The fees taken per transaction and then the fees on top of that to transfer the funds and then the fees on top of that to keep the product. Too many fees

Also, I had a customer dispute a transaction with her bank and won $2K. Stripe collected $2k from me and didn’t help me. I had the customer on camera, I had the contract with her signature and I had all emails/text messages from the customer. Stripe processed the dispute and lost. After that, I didn’t trust stripe. I stopped using them.

Reasons for Choosing Stripe

I thought stripe would be cheaper. It turned out the same but I went back to square because I can always get someone on the phone to help.Switched From

Square PaymentsReasons for Switching to Stripe

I thought the process was easier. The sign up was easy but it cost me more in the long run because of the amount of loss I ran.- Industry: Consumer Services

- Company size: Self Employed

- Used Monthly for 6-12 months

-

Review Source

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 10.0 /10

Why Stripe

Reviewed on 01/10/2024

I find Stripe offers many benefits to its customers.

Stripe allows businesses to start accepting...

I find Stripe offers many benefits to its customers.

Stripe allows businesses to start accepting payments almost instantly however refunds are a different story.

I like the fact Stripe exepts many patment methods.

Pros

I find Stripe cheaper then PayPal for most merchants.

I like these no set up or montly fees.

Stripe charges 1.50 % for online payments for all slandered u.k cards.

Cons

Stripe has Inadequate Customer Support whichbis a shame for such a popular company.

Refunds can take months.

Stripe FAQs

Below are some frequently asked questions for Stripe.Q. What type of pricing plans does Stripe offer?

Stripe offers the following pricing plans:

- Starting from: USD 0.30

- Free Trial: Not Available

Access a complete payments platform with simple, pay-as-you-go pricing that begins at 2.9% + 30¢ per successful card charge. Get everything you need to manage payments plus hundreds of feature updates per year with no monthly, setup, or hidden fees.

Q. Who are the typical users of Stripe?

Stripe has the following typical customers:

Self Employed, 2–10, 11–50, 51–200, 201–500, 501–1,000, 1,001–5,000

Q. What languages does Stripe support?

Stripe supports the following languages:

Bulgarian, Chinese, Czech, Danish, Dutch, English, Estonian, Finnish, German, Greek, Hungarian, Italian, Japanese, Latvian, Lithuanian, Malay, Norwegian, Polish, Portuguese, Romanian, Russian, Slovak, Slovenian, Spanish, Swedish, Turkish

Q. Does Stripe support mobile devices?

Stripe supports the following devices:

Android (Mobile), iPhone (Mobile), iPad (Mobile)

Q. What other apps does Stripe integrate with?

Stripe integrates with the following applications:

123FormBuilder, ABC Glofox, Accelevents, Accelo, AccountsPortal, Attribution, Avalara, Avaza, Baremetrics, BigCommerce, Bizness Apps, Blinksale, Bookinglayer, Bookwhen, ChargeKeep, Chargebee, ChartMogul, Chatfuel, Cheqbook Accounting, Cloudbeds, Commence, CoreCommerce, CrowdPower, Cyclr, Databox, Docusign, Ecwid, Elorus, Eventcube, Expensify, FormCrafts, FreeAgent, FreshBooks, GoDaddy Website Builder, GovOS, Gravity Forms, Harvest, Hiveage, IFTTT, Intercom, InvoiceSherpa, Invoiced, Involve.me, Jotform, Jumpseller, Keap, Keen IO, Leadpages, LeadsBridge, LearnWorlds, Lendio, LessAccounting, MYFUNDBOX, MakePlans, MemberSpace, Midigator, Nomod, Octobat, Operations Hub, PayDirt Payroll, Payfunnels, Payrexx, Paythen, Pelcro, PushPress, Quaderno, Recurly, RentMy, Rezgo, SecuraCart, Sellfy, Sellsy, Shift4Shop, ShipRush, ShipStation, Shopify, SimpleSpa, Skedda, SkyPrep, Slack, Slemma, Squarespace, Statsbot, Storefront Social, SumAll, SurveySparrow, TalentLMS, Tapfiliate, Ticket Tailor, Trustap, Typeform, UltraCart, Volusion, Wave, WeTravel, Weebly, WildApricot, Wishpond, Woopra, Wufoo, Xero, Xola, Zapier, Zoho Backstage, Zoho Billing, Zoho Books, Zoho Invoice

Q. What level of support does Stripe offer?

Stripe offers the following support options:

Email/Help Desk, FAQs/Forum, Knowledge Base, 24/7 (Live rep), Chat

Related categories

See all software categories found for Stripe.